Let’s be real here, folks. If you’ve got a Vanilla Visa card, you’re probably wondering how to keep tabs on your balance without losing your mind. Whether you’re using it for online shopping, paying bills, or treating yourself to that much-needed vacation, knowing your balance is key. And guess what? You’re in the right place because we’re about to break down everything you need to know about vanilla visa balance check in simple terms.

Now, I get it. The whole process might seem a bit overwhelming at first, but don’t sweat it. By the end of this guide, you’ll be checking your Vanilla Visa balance like a seasoned pro. So grab your favorite drink, get comfy, and let’s dive in.

Before we go any further, let’s quickly address why this matters. A Vanilla Visa card isn’t just another piece of plastic in your wallet. It’s a tool that gives you flexibility and control over your finances. But like any tool, you need to know how to use it properly. That’s where balance checks come into play. They help you stay on top of things and avoid any unpleasant surprises.

Read also:Halloween Spirit Return Policy Your Ultimate Guide For Costumes And Accessories

What is a Vanilla Visa Card Anyway?

Alright, let’s start with the basics. A Vanilla Visa card is essentially a prepaid card that you can load with money and use wherever Visa is accepted. It’s not a credit card, so there’s no debt to worry about. And unlike a debit card, it’s not tied to your bank account. Think of it as a middle ground that offers convenience and security.

Here’s the thing, though. Just like with any financial product, keeping track of your balance is crucial. You don’t want to find yourself in a situation where you’re trying to make a purchase, only to discover that you’re overdrawn. That’s where a vanilla visa balance check comes in handy.

Why Should You Care About Your Balance?

Let me paint you a picture. Imagine you’re out shopping and you see something you absolutely love. You whip out your Vanilla Visa card, feeling all confident, only to find out it’s declined. Not cool, right? This is why staying on top of your balance is so important.

- Avoid embarrassing moments at checkout counters.

- Prevent unnecessary fees for overdrafts or insufficient funds.

- Plan your spending wisely and stick to your budget.

- Stay informed about your financial health.

By regularly checking your balance, you’re taking charge of your finances. And who doesn’t want that?

How to Perform a Vanilla Visa Balance Check

Now that we’ve established why balance checks are essential, let’s talk about how to actually do it. There are several methods you can use, depending on what works best for you. Here’s a quick rundown:

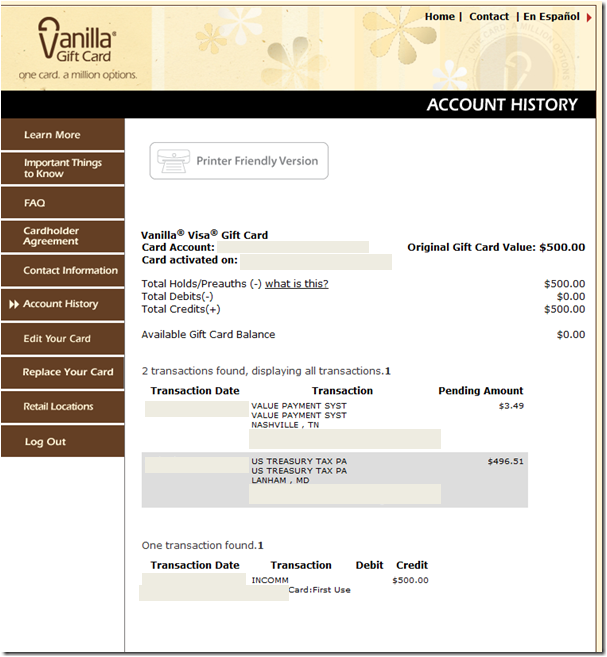

1. Check via the Vanilla Visa Website

One of the easiest ways to check your balance is through the official Vanilla Visa website. Here’s how:

Read also:Roseville Golfland Sunsplash Your Ultimate Guide To Family Fun

- Head over to the Vanilla Visa website.

- Click on the “Balance Check” option.

- Enter your card number and any other required information.

- Voila! Your balance will be displayed right there.

It’s as simple as that. Plus, the website is usually updated in real-time, so you’ll always have the most accurate information.

2. Use the Vanilla Visa Mobile App

In this day and age, who doesn’t love the convenience of a mobile app? The Vanilla Visa app lets you check your balance on the go, anytime and anywhere. Just download the app, log in with your credentials, and you’re good to go. Easy peasy.

And here’s a bonus tip: the app also allows you to track your transactions, set up alerts, and even lock your card if needed. Talk about peace of mind!

3. Call Customer Service

Sometimes, old-school methods are the way to go. If you’re not a fan of technology or just prefer human interaction, you can always call Vanilla Visa’s customer service. They’ll be happy to assist you with your balance inquiry. Just make sure to have your card handy so they can verify your information.

4. SMS or Text Messaging

Did you know you can check your balance via text message? Some Vanilla Visa cards offer this feature, allowing you to send a quick text to a designated number and receive your balance in return. It’s fast, efficient, and perfect for those who live and breathe their phones.

Tips for Managing Your Vanilla Visa Balance

Now that you know how to check your balance, let’s talk about how to manage it effectively. Here are a few tips to help you stay on top of things:

- Set up automatic alerts for low balances or suspicious activity.

- Keep track of your spending by reviewing your transaction history regularly.

- Replenish your card as needed to ensure you always have funds available.

- Consider setting a budget for your Vanilla Visa card to avoid overspending.

Remember, the goal is to use your card responsibly and make the most of its benefits. With a little effort and some smart strategies, you can achieve financial peace of mind.

Common Mistakes to Avoid

While we’re on the topic of balance management, let’s touch on some common mistakes people make. By avoiding these pitfalls, you’ll save yourself a lot of headaches down the road.

- Not checking your balance regularly, leading to unexpected declines.

- Overloading your card with funds you don’t actually have.

- Ignoring transaction alerts or notifications from Vanilla Visa.

- Sharing your card details with others, putting your account at risk.

By being mindful of these potential issues, you’ll be better equipped to handle your Vanilla Visa card with confidence.

Understanding Vanilla Visa Fees

Before we wrap things up, let’s talk about fees. Like most prepaid cards, Vanilla Visa comes with certain fees that you should be aware of. These can include:

- Activation fees when you first purchase the card.

- Monthly maintenance fees if you don’t meet certain usage requirements.

- ATM withdrawal fees if you use your card to withdraw cash.

- International transaction fees if you use your card abroad.

It’s important to understand these fees so you can plan accordingly. And don’t worry, most of them are pretty reasonable. Just make sure to read the fine print before signing up for a Vanilla Visa card.

How to Minimize Fees

Here are a few tips to help you minimize fees and get the most out of your Vanilla Visa card:

- Use your card regularly to avoid monthly maintenance fees.

- Stick to in-network ATMs to avoid withdrawal fees.

- Opt for digital transactions whenever possible to save on international fees.

By being strategic, you can keep your costs low and enjoy the full benefits of your card.

Conclusion: Take Control of Your Vanilla Visa Balance

Alright, folks, that’s a wrap. By now, you should have a solid understanding of how to perform a vanilla visa balance check and why it’s so important. Whether you choose to check your balance online, through the app, or via customer service, the key is to stay informed and proactive.

Remember, your Vanilla Visa card is a powerful tool that can help you manage your finances effectively. But like any tool, it requires care and attention. So take charge, stay on top of your balance, and make the most of what your card has to offer.

And hey, don’t forget to share this article with your friends and family. Knowledge is power, and the more people who know how to check their Vanilla Visa balance, the better. Thanks for reading, and happy balancing!

Table of Contents