Let’s talk about something that’s crucial when it comes to your American Express card – the CVV. If you’ve ever wondered what it is, why it matters, or how to use it safely, you’re in the right place. In this article, we’ll dive deep into the world of CVV codes on American Express cards, breaking down everything from its purpose to best practices for keeping your financial info secure. Whether you’re a seasoned cardholder or new to the world of credit cards, this guide has got your back.

Now, let’s be real here. The CVV might seem like just a bunch of numbers on your card, but trust me, it plays a big role in protecting your transactions. It’s like the secret handshake that tells merchants, “Hey, this person is legit.” And with fraud on the rise, understanding how CVV works is more important than ever.

So, buckle up because we’re about to break down everything you need to know about CVV on an American Express card. From the basics to advanced tips, we’ve got all the juicy details covered. Let’s get started!

Read also:Tw Pornstar The Rise Of Talent Fame And Influence In The Digital Age

Understanding CVV: What Exactly Is It?

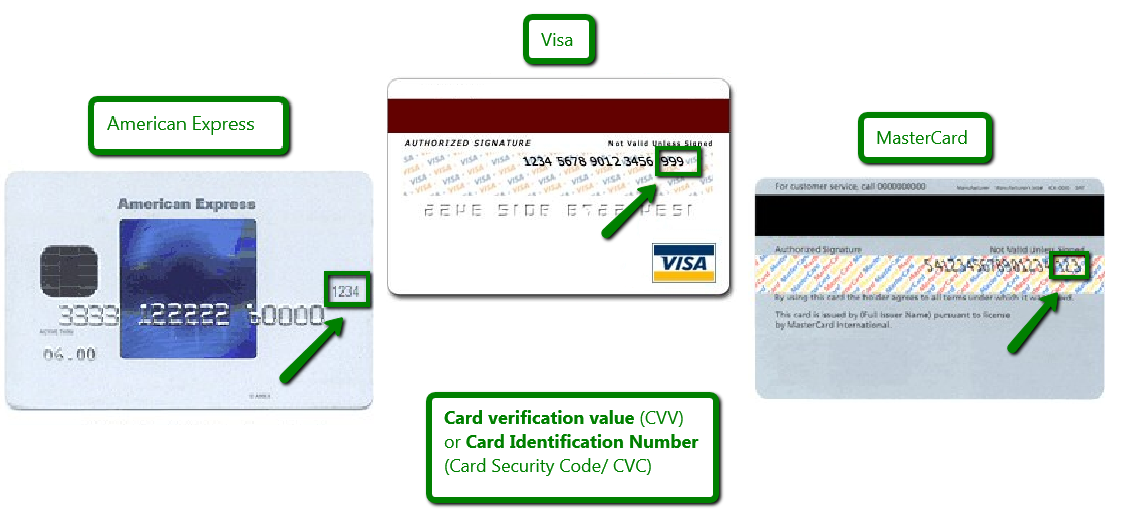

First things first, what even is a CVV? CVV stands for Card Verification Value, and it’s basically a security feature designed to prevent fraud during card-not-present transactions, like online shopping or phone orders. For American Express, the CVV is called a CID (Card Identification Number), but don’t worry, they’re pretty much the same thing.

Unlike other credit cards, American Express cards have a 4-digit CVV instead of the usual 3 digits. This little detail can trip people up sometimes, so it’s good to know upfront. The CVV is usually printed on the front of the card, above the card number, unlike Visa or Mastercard, which typically have it on the back.

Here’s the kicker – the CVV isn’t stored anywhere digitally, meaning hackers can’t easily steal it unless they physically get their hands on your card. That’s why it’s such a powerful tool in keeping your transactions secure.

Why Is CVV Important?

Okay, so why should you care about the CVV on your American Express card? Here’s the deal: the CVV adds an extra layer of security to your transactions. When you shop online or over the phone, merchants often ask for the CVV to verify that you’re the actual cardholder. It’s like a digital handshake that confirms, “Yes, I’m really the one using this card.”

Without the CVV, fraudsters would have an easier time using stolen card numbers. By requiring the CVV, merchants can help ensure that the person making the purchase has the physical card in hand. It’s a simple but effective way to protect your finances.

Where to Find the CVV on Your American Express Card

Alright, let’s get practical. If you’re new to American Express or just need a quick refresher, here’s where to find the CVV on your card. Unlike other credit cards, the CVV on an American Express is a 4-digit number located on the front of the card, above the main card number. Easy peasy, right?

Read also:Haleigh Cox Ig Your Ultimate Guide To The Rising Stars Instagram Fame

Here’s a quick step-by-step guide:

- Flip your American Express card over.

- Look at the front side of the card.

- Find the 4-digit number above the main card number. That’s your CVV.

And there you go! No need to search high and low – it’s right there in plain sight. Just remember, never share this number with anyone unless it’s absolutely necessary for a legitimate transaction.

Common Mistakes to Avoid When Using CVV

While the CVV is super useful, it’s also easy to mess up if you’re not careful. Here are a few common mistakes to avoid:

- Sharing the CVV unnecessarily: Only give out your CVV when making legitimate purchases. Never share it via email or text message.

- Writing it down: Keeping your CVV written somewhere makes it easier for others to steal. Memorize it if you can, or keep it safe if you must write it down.

- Using unsecured websites: Always make sure the website you’re shopping on is secure (look for the padlock icon in the URL bar) before entering your CVV.

By avoiding these pitfalls, you can keep your CVV – and your finances – safe and sound.

How Does CVV Protect You?

Let’s talk about the real magic of CVV: how it protects you from fraud. When you enter your CVV during an online transaction, the merchant sends it to the payment processor to verify that you’re the legitimate cardholder. Since the CVV isn’t stored digitally, fraudsters would need physical access to your card to get it. This makes it much harder for them to commit fraud.

In addition to preventing unauthorized transactions, CVV also helps merchants by reducing chargebacks. If a fraudulent transaction occurs and the CVV wasn’t used, the liability often falls on the merchant. By requiring the CVV, they can help protect themselves and their customers.

What Happens If Someone Gets Your CVV?

This is the scary part. If someone gets hold of your CVV, they can potentially use your card for unauthorized transactions. That’s why it’s crucial to protect your CVV like you would protect your PIN or password. If you suspect your CVV has been compromised, contact American Express immediately to freeze your account and issue a new card.

Here are some signs that your CVV might have been stolen:

- Unusual transactions on your account.

- Phishing emails or texts asking for your CVV.

- Unfamiliar charges on your monthly statement.

If you notice any of these red flags, act fast to protect your finances.

Best Practices for Using CVV Safely

Now that you know what CVV is and why it matters, let’s talk about how to use it safely. Here are some best practices to keep your CVV – and your money – secure:

- Never share your CVV: Only give it out during legitimate transactions. Never share it via email, text, or social media.

- Use secure websites: Always check for the padlock icon in the URL bar before entering your CVV online.

- Monitor your account: Regularly review your transactions to spot any suspicious activity.

- Enable alerts: Many banks and card issuers offer alerts for unusual transactions. Sign up for these to stay informed.

By following these tips, you can minimize the risk of fraud and keep your financial info safe.

What to Do If You Lose Your CVV

Lost your CVV? Don’t panic. Here’s what you can do:

- Find your card: Double-check your wallet, purse, or wherever you keep your cards.

- Check your account online: Many banks and card issuers let you view your card details online, including the CVV.

- Call customer service: If all else fails, contact American Express customer service to get a replacement card with a new CVV.

Remember, losing your CVV isn’t the end of the world. Just stay calm and take the necessary steps to recover it.

Is CVV the Same as PIN?

Here’s a question that often comes up: is the CVV the same as your PIN? The short answer is no. While both are security features, they serve different purposes. The CVV is used for card-not-present transactions, like online shopping, while the PIN is used for in-person transactions, like ATM withdrawals or debit card purchases.

Think of it this way: the CVV is your digital security code, while the PIN is your physical security code. Both are important, but they work in different ways to protect your finances.

Can You Change Your CVV?

Unlike a PIN, you can’t change your CVV. It’s printed on your card and tied to your account. However, if you suspect your CVV has been compromised, you can request a new card with a new CVV from American Express. This is a good idea if you notice any suspicious activity on your account.

CVV on Different Types of American Express Cards

American Express offers a variety of card options, from the classic Green Card to the iconic Black Card. While the CVV is generally the same across all cards – a 4-digit number on the front – there are some differences to be aware of:

- Green Card: The basic card with a 4-digit CVV.

- Gold Card: Offers more perks and a 4-digit CVV.

- Platinum Card: High-end card with enhanced security features and a 4-digit CVV.

- Centurion Card (Black Card): The ultimate card with top-tier security and a 4-digit CVV.

No matter which card you choose, the CVV remains a key security feature. Just make sure to keep it safe and use it wisely.

Why Do Different Cards Have the Same CVV Format?

Good question. The reason all American Express cards have the same CVV format – a 4-digit number on the front – is to maintain consistency across their product line. This makes it easier for merchants and cardholders to recognize and use the CVV, regardless of which card they’re using.

Conclusion: Stay Safe and Stay Smart

So, there you have it – everything you need to know about CVV on an American Express card. From understanding what it is to using it safely, we’ve covered all the bases. Remember, the CVV is a powerful tool in protecting your finances, but it’s only effective if you use it wisely.

Here’s a quick recap of the key takeaways:

- The CVV is a 4-digit number located on the front of your American Express card.

- It adds an extra layer of security to your transactions.

- Always keep your CVV safe and never share it unnecessarily.

- If you suspect fraud, contact American Express immediately.

Now that you’re armed with knowledge, go forth and shop safely! And if you found this article helpful, don’t forget to share it with your friends and family. Let’s spread the word about staying safe in the digital age.

Call to Action

Got questions or comments? Drop them below! We’d love to hear from you and help answer any lingering doubts you might have. And if you’re looking for more tips on staying safe online, check out our other articles. Stay secure, stay smart, and happy shopping!

Table of Contents

Understanding CVV: What Exactly Is It?

Where to Find the CVV on Your American Express Card

Best Practices for Using CVV Safely

CVV on Different Types of American Express Cards

Conclusion: Stay Safe and Stay Smart

Common Mistakes to Avoid When Using CVV

What Happens If Someone Gets Your CVV?

What to Do If You Lose Your CVV

What to Do If You Lose Your CVV

![American Express CID (CVV) Code Guide [2022] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2021/03/Platinum-Card-CID.jpg)

![American Express CID (CVV) Code Guide [2022] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2021/03/Discover-CVV.jpg)