Hey there, folks! Let’s talk about something that probably every online shopper, traveler, and cardholder has encountered at some point: the CVV number. But wait, what exactly is the CVV number of American Express? If you’ve ever scratched your head while staring at your AmEx card, wondering where this magical security code is hiding, well, you’re not alone. Today, we’re diving deep into the world of CVV numbers, focusing on American Express and why it matters. So buckle up, because we’re about to decode the mystery behind those digits. trust me, it’s gonna be a wild ride.

Before we get into the nitty-gritty, let’s clear the air. CVV stands for Card Verification Value, and it’s basically a secret code that verifies your card is legit when you’re making purchases online or over the phone. But here’s the thing—American Express doesn’t call it a CVV. Nope, they’ve got their own fancy term for it. Stick around, and we’ll spill all the tea on this little security feature that plays a huge role in protecting your finances.

Now, why does this matter? In today’s digital age, where online shopping is as common as brushing your teeth, understanding your CVV number is crucial. It’s like the bouncer at a club—no CVV, no entry. So whether you’re booking flights, buying groceries, or splurging on that dream pair of sneakers, knowing your CVV number (and how to use it safely) can save you a ton of trouble. Let’s dig in!

Read also:Bagatelle Miami A Paradise For Foodies And Party Lovers

What Exactly Is the CVV Number?

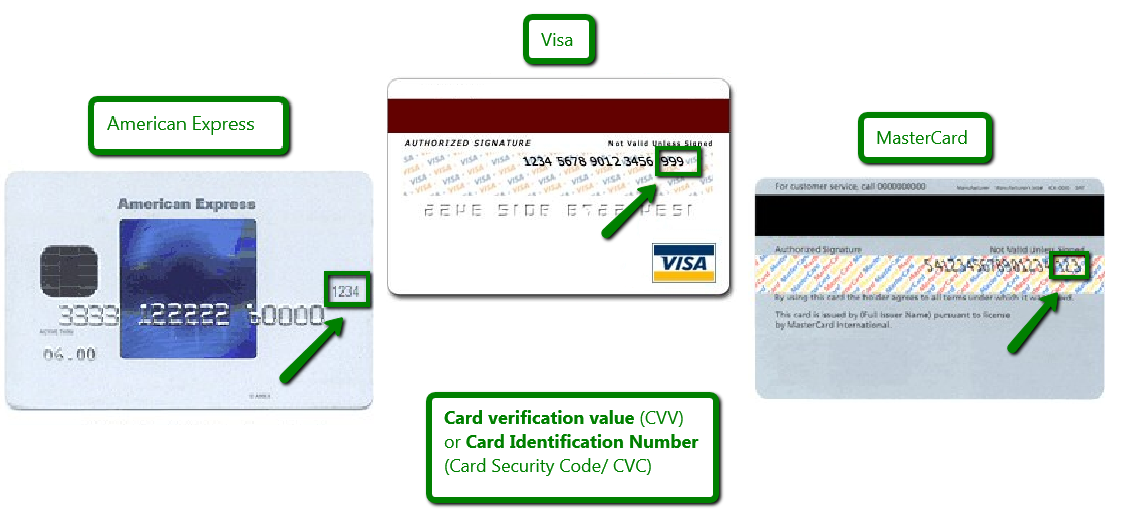

Alright, let’s break it down. The CVV number is a short code printed on your credit or debit card. It’s used to confirm that you actually have the physical card in your possession when making transactions online or over the phone. Think of it as your card’s personal ID badge. For most cards, this is a three-digit code located on the back, usually next to the signature strip. But American Express? Oh, they do things a little differently.

Instead of calling it a CVV, American Express refers to it as the CID (Card Identification Number). And guess what? It’s not even on the back of the card. Yep, you heard that right. The CID for AmEx cards is a four-digit code printed on the front, above the card number. See? Told you they’re special.

Why Is the CVV Number Important?

Here’s the deal: the CVV number is a crucial layer of security in the world of card payments. It helps prevent fraud by ensuring that the person making the transaction has the actual card in hand. Without the CVV, someone could potentially steal your card number and go on a shopping spree. But if they don’t have the CVV, most merchants will block the transaction. Pretty slick, right?

It’s also worth noting that CVV numbers are not stored by merchants. This means that even if a retailer gets hacked, your CVV remains safe. It’s like a secret handshake between you, your card, and the merchant. And speaking of secrets, let’s talk about how American Express handles this whole thing.

Where to Find the CVV Number on an American Express Card

Now, here’s the part where we get hands-on. If you’ve got an American Express card, flip it over… wait, no, don’t flip it! Look at the front. See that little group of four numbers above your card number? That’s your CID. Unlike other cards, AmEx doesn’t hide their security code on the back. They keep it right where you can see it, like a bold statement saying, “We’re different, and we’re proud of it.”

But why does AmEx do this? Well, it’s all about security and convenience. By placing the CID on the front, they make it harder for fraudsters to copy the code without physically having the card. Plus, it’s one less step for cardholders when shopping online. Win-win, right?

Read also:Los Girasoles Unveiling The Hidden Beauty Of Sunflower Wonders

How Does the CVV Number Work?

When you enter your CVV number during an online transaction, the merchant sends it to the card issuer for verification. If the CVV matches the one on file, the transaction goes through. If it doesn’t, the transaction gets declined. Simple, right? But here’s the kicker: the CVV is only used for card-not-present transactions, like online shopping or phone orders. If you’re swiping or inserting your card at a store, the CVV isn’t needed.

And just to clarify, the CVV isn’t the same as your PIN. Your PIN is used for in-person transactions, while the CVV is for remote ones. It’s like having two different keys for two different doors. One unlocks your physical card, and the other unlocks your digital transactions.

Is the CVV Number the Same as the CID?

For most cards, the CVV and CID are pretty much the same thing. But as we’ve learned, American Express likes to march to the beat of its own drum. While other cards call it a CVV, AmEx insists on calling it a CID. But at the end of the day, they serve the same purpose: to verify your identity during transactions.

So, why the different names? Well, it’s all about branding. American Express wanted to differentiate themselves from the competition, and what better way to do that than by giving their security code a unique name? It’s a clever move that reinforces their image as a premium card issuer.

Key Differences Between CVV and CID

- CVV is used by most card issuers, while CID is exclusive to American Express.

- CVV is usually a three-digit code, while CID is a four-digit code.

- CVV is located on the back of the card, while CID is on the front.

How to Protect Your CVV Number

Now that you know what the CVV number is and why it’s important, let’s talk about how to keep it safe. Your CVV is like a treasure chest of sensitive information, so you need to guard it like a dragon. Here are a few tips to help you protect your CVV:

- Don’t write your CVV number down anywhere. If you must, keep it in a secure place and never store it digitally.

- Be cautious when entering your CVV online. Only shop on trusted websites and look for the padlock icon in the URL bar.

- Monitor your account regularly for any suspicious activity. If you notice anything fishy, report it to your card issuer immediately.

- Shred any documents that contain your CVV number before throwing them away.

Remember, your CVV is your first line of defense against fraud. Treat it with the respect it deserves.

Common Misconceptions About the CVV Number

There’s a lot of misinformation floating around about CVV numbers, so let’s clear some of it up. Here are a few common myths debunked:

- Myth: The CVV number is stored by merchants. Fact: Merchants are not allowed to store CVV numbers for security reasons.

- Myth: The CVV number is the same as the expiration date. Fact: The CVV is a separate code that has nothing to do with your card’s expiration date.

- Myth: You can use your CVV number for in-person transactions. Fact: The CVV is only used for card-not-present transactions.

See? Sometimes the truth is simpler than the rumors would have you believe.

What Happens If Someone Steals Your CVV Number?

This is the million-dollar question, isn’t it? If someone gets their hands on your CVV number, they can potentially make unauthorized transactions in your name. But don’t panic just yet. Most card issuers, including American Express, offer zero liability protection. This means you won’t be held responsible for any fraudulent charges made on your account.

However, it’s still important to act quickly if you suspect your CVV has been compromised. Contact your card issuer immediately and request a new card with a new CVV. They’ll take care of the rest, but the faster you act, the better.

Can You Change Your CVV Number?

Here’s a question that pops up a lot: can you change your CVV number if you think it’s been compromised? The short answer is no. Unlike your PIN, which you can change at any time, your CVV is tied to your physical card. The only way to get a new CVV is to request a replacement card from your issuer.

But don’t worry—it’s a pretty straightforward process. Most card issuers will send you a new card within a few days, and your old CVV will automatically become invalid. Just be sure to update any auto-pay services you have set up with the new card info.

Final Thoughts: Why the CVV Number Matters

So there you have it, folks. The CVV number of American Express—better known as the CID—is more than just a bunch of digits. It’s a vital piece of the puzzle when it comes to protecting your finances. Whether you’re booking a flight, buying groceries, or splurging on that dream pair of sneakers, knowing how to use and protect your CVV can save you a ton of trouble.

Remember, your CVV is your best friend in the world of online shopping. Treat it with care, and it’ll return the favor by keeping your accounts safe and secure. And if you ever suspect foul play, don’t hesitate to reach out to your card issuer. They’re there to help, and they take security very seriously.

So what are you waiting for? Go ahead and check out that shiny new card of yours. Find that CID, give it a little pat, and thank it for all the hard work it does to keep you safe. And while you’re at it, why not share this article with your friends? Knowledge is power, and the more people know about CVV numbers, the safer we all are.

Table of Contents

- What Exactly Is the CVV Number?

- Why Is the CVV Number Important?

- Where to Find the CVV Number on an American Express Card

- How Does the CVV Number Work?

- Is the CVV Number the Same as the CID?

- How to Protect Your CVV Number

- Common Misconceptions About the CVV Number

- What Happens If Someone Steals Your CVV Number?

- Can You Change Your CVV Number?

- Final Thoughts: Why the CVV Number Matters

![American Express CID (CVV) Code Guide [2022] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2021/03/Platinum-Card-CID.jpg)

![American Express CID (CVV) Code Guide [2022] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2021/03/Discover-CVV.jpg)