Have you ever wondered how to take control of your finances with a Balance Visa Vanilla card? Well, buckle up because we're diving deep into everything you need to know about this game-changing financial tool. Whether you're a first-timer or looking to optimize your current setup, this guide has got you covered. Balance Visa Vanilla isn't just a card; it's a lifestyle change waiting to happen.

In today's fast-paced world, managing finances can feel like juggling flaming torches while riding a unicycle. That's where Balance Visa Vanilla comes in. Designed to simplify your life, this card offers flexibility, security, and perks that make budgeting a breeze. So, if you're tired of the financial rollercoaster, keep reading!

Before we dive into the nitty-gritty, let's set the stage. This isn't just another article about credit cards. We're here to give you actionable insights, insider tips, and strategies to help you make the most of your Balance Visa Vanilla. By the end of this, you'll be ready to conquer your financial goals with confidence.

Read also:Ayce Sushi The Ultimate Allyoucaneat Sushi Experience

What is Balance Visa Vanilla Anyway?

Let's start with the basics. The Balance Visa Vanilla card is a prepaid debit card that lets you load funds and spend them wherever Visa is accepted. Think of it as a wallet in your pocket that you can control down to the penny. No credit checks, no interest rates, and no hidden fees. Sounds too good to be true? Keep reading, and we'll break it all down for you.

Why Should You Care About Balance Visa Vanilla?

Here's the deal: traditional banking isn't always the best fit for everyone. Maybe you're not ready for a credit card, or perhaps you want to avoid the temptation of overspending. Balance Visa Vanilla offers a middle ground that gives you the convenience of a Visa card without the strings attached. Plus, it's perfect for budgeting, saving, and managing expenses.

Key Features You Need to Know

Now, let's talk about what makes this card so special. Here are some of the standout features:

- No credit checks required

- Load funds easily through bank transfers or direct deposits

- Use it anywhere Visa is accepted

- Access to mobile apps for real-time tracking

- No overdraft fees or interest charges

These features make Balance Visa Vanilla an ideal choice for anyone looking to take charge of their finances without the hassle of traditional banking.

How Does Balance Visa Vanilla Work?

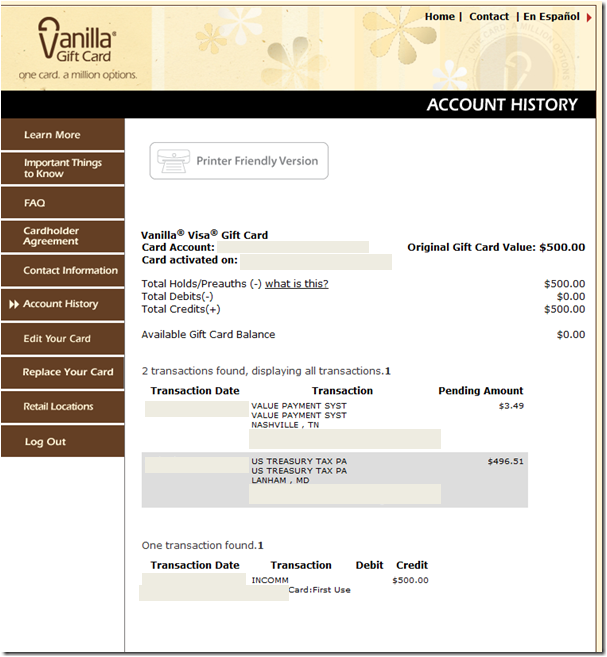

Using Balance Visa Vanilla is as simple as loading, spending, and tracking. You load money onto the card, use it wherever Visa is accepted, and monitor your transactions through the app or online portal. It's like having a personal finance assistant in your pocket. Plus, you can set spending limits, lock the card remotely, and even receive alerts for suspicious activity.

Step-by-Step Guide to Getting Started

Ready to get started? Here's a quick guide:

Read also:Arie Crown Theater The Ultimate Guide To Chicagos Iconic Venue

- Sign up for an account on the official website

- Verify your identity using a government-issued ID

- Load funds onto your card via bank transfer or direct deposit

- Start using your card for purchases, bills, or ATM withdrawals

It's that easy! And the best part? You can manage everything from your smartphone, making it perfect for the tech-savvy individual.

Benefits of Using Balance Visa Vanilla

So, why should you choose Balance Visa Vanilla over other prepaid cards? Let's break it down:

- Control: Manage your spending with ease and avoid the temptation of credit card debt.

- Security: With fraud protection and remote card-locking, your money is safer than ever.

- Convenience: Use it anywhere Visa is accepted, both online and offline.

- Cost-Effective: No interest rates or hidden fees mean you keep more of your money.

These benefits make Balance Visa Vanilla a top choice for anyone looking to streamline their finances.

Common Misconceptions About Balance Visa Vanilla

There are a few myths floating around about prepaid cards in general, and Balance Visa Vanilla is no exception. Let's clear the air:

Myth 1: "It's only for people with bad credit." False! While it's true that Balance Visa Vanilla doesn't require a credit check, it's a great option for anyone who wants to avoid credit card debt or simply prefers a prepaid solution.

Myth 2: "There are tons of hidden fees." Not true! Balance Visa Vanilla is transparent about its fees, and there are no surprises. Plus, many features come at no extra cost.

Debunking the Myths

By understanding the facts, you can make an informed decision about whether Balance Visa Vanilla is right for you. And let's be honest, who doesn't love cutting through the noise and getting to the truth?

Who Uses Balance Visa Vanilla?

Balance Visa Vanilla isn't just for one specific group of people. It's used by a wide range of individuals, from students to small business owners. Here are a few examples:

- Students: Perfect for managing a tight budget while avoiding credit card debt.

- Freelancers: Ideal for receiving payments and managing expenses on the go.

- Travelers: Great for international travel with no foreign transaction fees.

No matter who you are, there's a good chance Balance Visa Vanilla can help you achieve your financial goals.

How to Maximize Your Balance Visa Vanilla Experience

Now that you know the basics, let's talk about how to get the most out of your card. Here are a few tips:

- Set spending limits to stay within your budget

- Use the app to track your transactions in real-time

- Take advantage of direct deposits for faster access to your funds

- Enable notifications for suspicious activity to stay secure

By following these tips, you'll be well on your way to mastering your Balance Visa Vanilla experience.

Pro Tips from the Pros

Want to take it to the next level? Consider these expert tips:

- Use the card for recurring bills to simplify your life

- Set up automatic reloads to avoid running out of funds

- Explore additional features like gift card purchases

With these strategies, you'll be using your card like a pro in no time.

Where Can You Use Balance Visa Vanilla?

The short answer? Anywhere Visa is accepted. That includes:

- Online retailers like Amazon and eBay

- Brick-and-mortar stores like Walmart and Target

- ATMs for cash withdrawals

- Bill payments and subscriptions

With such widespread acceptance, Balance Visa Vanilla is a versatile tool for all your financial needs.

International Usage

Thinking about traveling abroad? Balance Visa Vanilla has you covered. Use it for everything from hotel bookings to souvenirs without worrying about foreign transaction fees. It's like having a global wallet in your pocket.

Conclusion: Take Control of Your Finances Today

There you have it, folks! Balance Visa Vanilla is more than just a prepaid card; it's a powerful tool for taking control of your finances. With its simplicity, security, and convenience, it's no wonder so many people are making the switch. So, what are you waiting for?

Ready to join the Balance Visa Vanilla revolution? Sign up today and start your journey to financial freedom. And don't forget to share this article with your friends and family. After all, knowledge is power, and the more people who know about Balance Visa Vanilla, the better!

Table of Contents

- What is Balance Visa Vanilla Anyway?

- Why Should You Care About Balance Visa Vanilla?

- How Does Balance Visa Vanilla Work?

- Benefits of Using Balance Visa Vanilla

- Common Misconceptions About Balance Visa Vanilla

- Who Uses Balance Visa Vanilla?

- How to Maximize Your Balance Visa Vanilla Experience

- Where Can You Use Balance Visa Vanilla?

- International Usage

- Conclusion