Ever wondered how to take control of your Vanilla Visa Card balance and make the most out of it? Well, you're not alone. Millions of people just like you are looking for ways to maximize their financial tools. Whether you're using it for everyday purchases, managing expenses, or even as a gift card, understanding your Vanilla Visa Card balance is key to financial freedom. So, buckle up because we’re diving deep into everything you need to know!

Let’s face it, life can get unpredictable. Sometimes you need that extra financial cushion, and that’s where your Vanilla Visa Card comes in handy. But how do you keep track of your balance? How can you ensure you’re using it efficiently? In this article, we’ll break it all down for you, step by step, so you can feel confident and in control of your finances.

From checking your balance to maximizing rewards, we’ve got you covered. Stick around, and by the end of this read, you’ll be a pro at managing your Vanilla Visa Card balance like a boss. Let’s get started!

Read also:Halloween Spirit Return Policy Your Ultimate Guide For Costumes And Accessories

What Exactly is a Vanilla Visa Card?

Before we dive into the nitty-gritty of your Vanilla Visa Card balance, let’s first understand what this card really is. A Vanilla Visa Card is essentially a prepaid debit card that allows you to load funds onto it and use it wherever Visa is accepted. Think of it as a versatile financial tool that gives you the flexibility to manage your money on the go.

Now, here’s the kicker – unlike traditional credit cards, you don’t have to worry about interest rates or debt with a Vanilla Visa Card. You spend only what you load onto the card, making it a great option for budget-conscious individuals. Plus, it’s accepted almost everywhere Visa is, so you’ve got that extra peace of mind when making purchases.

Why Tracking Your Vanilla Visa Card Balance Matters

Okay, here’s the deal – keeping an eye on your Vanilla Visa Card balance is more important than you might think. Imagine this: you’re about to make a purchase, and BAM! Your card gets declined. Not a great feeling, right? That’s why staying on top of your balance is crucial.

Tracking your balance helps you avoid embarrassing situations, ensures you’re not overspending, and keeps your financial goals in check. Plus, it’s a great way to stay organized and make the most out of your prepaid card experience. So, how exactly do you keep tabs on your balance? Let’s find out.

How to Check Your Vanilla Visa Card Balance

Checking your Vanilla Visa Card balance is easier than you think. Here’s a quick rundown of the methods you can use:

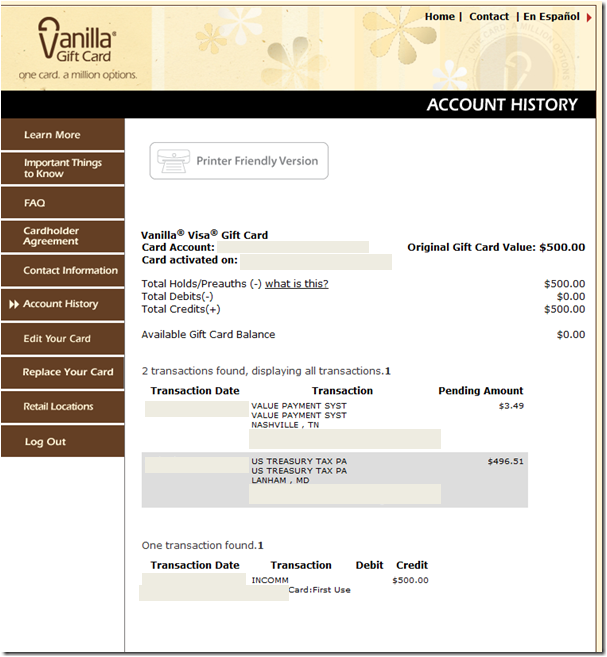

- Online Account Access: If you’ve set up an online account, simply log in to your Vanilla Visa Card dashboard. It’s like having a personal finance assistant at your fingertips.

- Mobile App: Download the official Vanilla Visa Card app and monitor your balance on the go. Who doesn’t love convenience, right?

- Customer Service: Give them a call or send a quick text to check your balance. Sometimes, talking to a real person can be refreshing.

- ATM: Swipe your card at any ATM that accepts Visa, and voila! Your balance will pop up in no time.

See? It’s not rocket science. With these methods, you’ll always know where you stand financially. Now, let’s move on to some pro tips for managing your balance effectively.

Read also:Mill Valley Public Library Your Ultimate Community Hub For Knowledge And Adventure

Tips for Managing Your Vanilla Visa Card Balance

Managing your Vanilla Visa Card balance doesn’t have to be a chore. Here are some practical tips to help you stay on top of your game:

- Set a Budget: Decide how much you want to load onto your card each month. This way, you’ll have a clear plan and avoid overspending.

- Track Your Spending: Use the app or online dashboard to monitor your transactions. It’s like having a financial diary that keeps you accountable.

- Reload Strategically: Don’t wait until your balance is dangerously low. Reload when you know you’ll need it, like before a big shopping trip or vacation.

- Maximize Rewards: Some Vanilla Visa Cards offer rewards or cashback. Take advantage of these perks to stretch your budget further.

By following these tips, you’ll not only manage your balance better but also enhance your overall financial well-being. Now, let’s explore some common questions people have about Vanilla Visa Card balances.

Frequently Asked Questions About Vanilla Visa Card Balance

Here are some FAQs that might help clear up any confusion you have about your Vanilla Visa Card balance:

Can I Check My Balance Without an Internet Connection?

Absolutely! You can check your balance by calling customer service or visiting an ATM. No Wi-Fi needed!

What Happens If I Overspend My Balance?

Good news – you can’t overspend with a Vanilla Visa Card because you can only spend what’s loaded onto it. It’s like having a built-in safety net.

Is There a Fee for Checking My Balance?

Mostly, no. Checking your balance through the app or online is usually free. However, ATM checks might come with a small fee, so it’s always good to double-check.

Now that we’ve covered the FAQs, let’s dive into some stats that might surprise you about Vanilla Visa Cards.

Stats and Insights: The Power of Vanilla Visa Cards

Did you know that prepaid cards like the Vanilla Visa Card are becoming increasingly popular? According to recent studies, the prepaid card market is expected to grow significantly over the next few years. Why? Because people are realizing the benefits of having a prepaid card in their wallet.

Some interesting stats include:

- Over 70% of prepaid card users report feeling more in control of their finances.

- Prepaid cards are used by millions of people worldwide for everything from daily expenses to travel.

- Vanilla Visa Cards, in particular, are praised for their ease of use and wide acceptance.

These numbers speak volumes about the growing trust and reliance on prepaid cards like the Vanilla Visa Card. Next up, let’s talk about how to choose the right prepaid card for you.

Choosing the Right Prepaid Card for Your Needs

Not all prepaid cards are created equal. When it comes to selecting the right one for you, consider these factors:

- Fees: Look for cards with low or no fees. The last thing you want is to lose money on hidden charges.

- Features: Some cards offer additional perks like fraud protection, mobile apps, and reload options. Choose one that aligns with your needs.

- Acceptance: Ensure the card is widely accepted wherever you shop. Vanilla Visa Cards, for instance, are accepted wherever Visa is.

By doing your homework, you’ll find a prepaid card that fits perfectly into your lifestyle. Now, let’s wrap things up with some final thoughts.

Conclusion: Take Control of Your Vanilla Visa Card Balance

Managing your Vanilla Visa Card balance doesn’t have to be complicated. By understanding what the card is, how to check your balance, and implementing smart strategies, you can take charge of your finances. Remember, it’s all about staying informed and making the most out of your financial tools.

So, what’s next? Take action! Check your balance, set a budget, and explore the features your Vanilla Visa Card offers. Don’t forget to share this article with friends or family who might benefit from it. Together, let’s make financial freedom a reality!

Table of Contents

- What Exactly is a Vanilla Visa Card?

- Why Tracking Your Vanilla Visa Card Balance Matters

- How to Check Your Vanilla Visa Card Balance

- Tips for Managing Your Vanilla Visa Card Balance

- Frequently Asked Questions About Vanilla Visa Card Balance

- Stats and Insights: The Power of Vanilla Visa Cards

- Choosing the Right Prepaid Card for Your Needs

- Conclusion: Take Control of Your Vanilla Visa Card Balance

And there you have it – everything you need to know about your Vanilla Visa Card balance. Happy managing, and remember, your financial future is in your hands!