So here's the deal, checking your Vanilla Visa balance doesn't have to be rocket science. In today's fast-paced world, knowing how much you've got on your Vanilla Visa card can save you from awkward moments at the checkout counter, right? Whether you're using it for online shopping or just want to keep track of your spending, understanding how to check that balance is super important. Let's dive in and make this whole process as smooth as butter.

But first, let's address the elephant in the room—why Vanilla Visa? Well, it's like the unsung hero of prepaid cards. It’s versatile, widely accepted, and gives you the freedom to manage your money without the hassle of a traditional bank account. And hey, who doesn’t love a little financial independence? But before we get too deep into the nitty-gritty, let’s set the stage. This article is all about helping you master the art of checking your Vanilla Visa balance like a pro.

Now, buckle up because we’re about to break it down step by step. From understanding the basics to exploring different methods, we’ve got you covered. By the end of this, you'll be navigating your Vanilla Visa balance like a boss. So, let's get started and make sure you're never caught off guard again. Trust me, your wallet will thank you for it later.

Read also:Thermatru Doors The Ultimate Guide To Enhancing Your Homes Security And Style

Understanding Vanilla Visa: The Basics

What is Vanilla Visa Anyway?

Alright, let’s start with the basics. Vanilla Visa is more than just a prepaid card; it’s your gateway to financial flexibility. Think of it as a wallet on a card. You load it with cash, and boom—you’re ready to shop, pay bills, or even travel. The best part? No credit checks, no monthly fees, and no hidden surprises. It’s like having a sidekick that helps you manage your money without all the drama.

But here’s the kicker—Vanilla Visa isn’t just for big spenders. It’s perfect for anyone looking to keep their finances in check. Whether you’re budgeting for groceries or planning a weekend getaway, this card has got your back. And the cherry on top? You can check your balance anytime, anywhere. But how exactly do you do that? Let’s find out.

Why Checking Your Balance Matters

Stay in Control of Your Finances

Let’s be real—no one likes being blindsided by an empty wallet. That’s why checking your Vanilla Visa balance regularly is a game-changer. It’s like having a personal finance coach in your pocket. By keeping tabs on your balance, you can avoid overspending and make smarter financial decisions. Plus, it helps you stay on top of any unexpected transactions or errors.

And here’s the thing—Vanilla Visa makes it super easy to check your balance. Whether you’re using your phone, computer, or even a good old-fashioned phone call, you’ve got options. It’s all about finding what works best for you. So, whether you’re a tech-savvy millennial or prefer the old-school way, Vanilla Visa has got you covered. Now, let’s break down the methods, shall we?

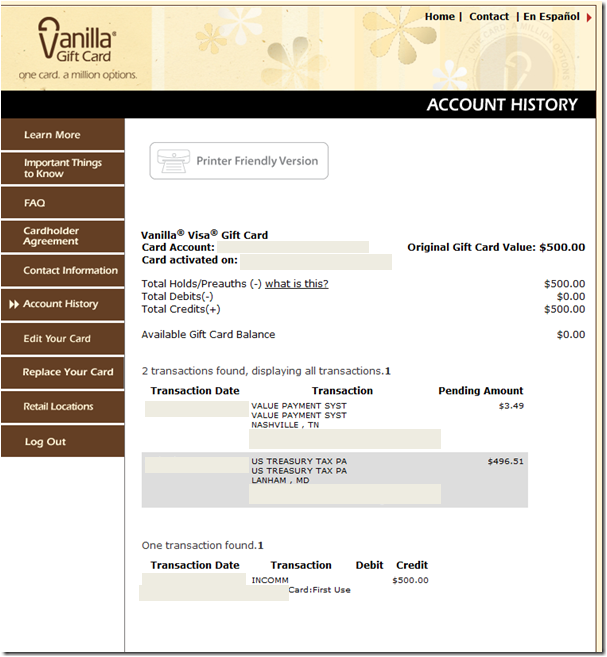

Method 1: Check Your Balance Online

Step-by-Step Guide to Online Balance Checking

Okay, let’s talk about the easiest way to check your Vanilla Visa balance—online. First things first, you’ll need to visit the official Vanilla Visa website. Don’t worry; it’s safe, secure, and super user-friendly. Once you’re there, look for the “Check Balance” option. You’ll need your card number handy, so grab that before you start.

Now, here’s where it gets interesting. Some Vanilla Visa cards come with a PIN or an account number for added security. If yours does, make sure you’ve got that info ready. Once you’ve entered all the required details, click submit, and voilà! Your balance will pop up faster than you can say “prepaid card.” Easy peasy, right?

Read also:Daisy Phoenix Rising Star In The Spotlight

Method 2: Checking Your Balance via Mobile App

Why the Mobile App is Your Best Friend

Let’s face it—our phones are practically glued to our hands these days. So, why not use them to check your Vanilla Visa balance? The Vanilla Visa mobile app is a lifesaver. It’s available on both Android and iOS, so no matter what phone you’ve got, you’re good to go. Download it, create an account (if you haven’t already), and link your card. It’s that simple.

Once you’re logged in, your balance will be right there on the home screen. No more hunting around for numbers or waiting for updates. Plus, the app lets you view your transaction history, set up alerts, and even reload your card—all in one place. It’s like having a personal assistant for your finances. Who wouldn’t want that?

Method 3: Checking Your Balance by Phone

Old-School Cool: The Phone Method

Not everyone’s a fan of screens, and that’s okay. If you prefer the good old-fashioned way, Vanilla Visa’s got you covered. Simply dial the toll-free number found on the back of your card. You’ll be greeted by an automated system that will guide you through the process. Again, you’ll need your card number and possibly a PIN, so keep those handy.

The beauty of this method is that it’s available 24/7. No need to wait for bank hours or worry about Wi-Fi connections. Just pick up the phone, follow the prompts, and boom—you’ve got your balance in seconds. It’s like having a financial hotline in your pocket. Pretty cool, right?

Method 4: Checking Your Balance at an ATM

ATM Balance Checks: Quick and Convenient

Who says ATMs are just for cash? You can also use them to check your Vanilla Visa balance. Simply insert your card, enter your PIN, and select the “Check Balance” option. Your balance will appear on the screen in no time. Plus, you can take care of other tasks while you’re there, like withdrawing cash or printing a mini statement.

Just a heads-up—some ATMs might charge a fee for balance inquiries, so it’s always good to check beforehand. But if you’re in a pinch and need a quick answer, this method works like a charm. It’s all about finding what works best for you and your lifestyle.

Common Mistakes to Avoid When Checking Your Balance

Don’t Fall for These Traps

Now that we’ve covered the methods, let’s talk about what not to do. One common mistake is forgetting your PIN or account number. Trust me, it happens to the best of us. To avoid this, keep your info in a safe place where you can easily access it. Another pitfall is not double-checking the website or app you’re using. Always make sure it’s the official Vanilla Visa platform to avoid scams.

Also, be mindful of fees. Some methods, like ATM balance checks, might come with a small cost. It’s always a good idea to review your card’s terms and conditions to stay informed. Lastly, don’t neglect your transaction history. Regularly reviewing it can help you spot any discrepancies or unauthorized charges. Stay vigilant, and you’ll be golden.

Tips for Managing Your Vanilla Visa Balance

Maximizing Your Card’s Potential

So, you’ve got your balance under control. Now what? Here are a few tips to help you make the most of your Vanilla Visa card. First, set a budget. Knowing how much you have on your card is great, but setting limits can help you avoid overspending. Use the mobile app to track your expenses and adjust as needed.

Next, take advantage of reload options. Whether it’s through direct deposit, bank transfer, or even cash reloads, keeping your card topped up can save you from last-minute stress. And don’t forget about rewards programs. Some Vanilla Visa cards offer perks like cashback or discounts, so it’s worth exploring what’s available. Lastly, stay informed. Keep an eye on any updates or changes to your card’s policies to ensure you’re always in the know.

Security Measures to Protect Your Vanilla Visa

Keep Your Card Safe and Sound

Security is key when it comes to prepaid cards. To protect your Vanilla Visa, start by keeping your PIN confidential. Don’t share it with anyone, not even your best friend. Also, be cautious when using public Wi-Fi to check your balance. It’s always safer to use a secure network to avoid potential breaches.

Another smart move is to enroll in fraud protection services. Many prepaid cards, including Vanilla Visa, offer this feature to help safeguard your account. Lastly, monitor your account regularly. If you notice any suspicious activity, report it immediately to the card issuer. Prevention is the best defense, so stay vigilant and keep your card secure.

Conclusion: Mastering Your Vanilla Visa Balance

And there you have it—a comprehensive guide to checking your Vanilla Visa balance. From online methods to good old-fashioned phone calls, you’ve got options galore. The key is finding what works best for you and sticking with it. Remember, staying informed about your finances is the first step toward financial freedom.

So, what are you waiting for? Take control of your Vanilla Visa balance today. Whether you’re budgeting for the future or just keeping an eye on your spending, this guide has got you covered. Don’t forget to share your newfound knowledge with friends and family. After all, who doesn’t love a little financial wisdom? Now go forth and conquer your Vanilla Visa balance like a pro!

Table of Contents

- Understanding Vanilla Visa: The Basics

- Why Checking Your Balance Matters

- Method 1: Check Your Balance Online

- Method 2: Checking Your Balance via Mobile App

- Method 3: Checking Your Balance by Phone

- Method 4: Checking Your Balance at an ATM

- Common Mistakes to Avoid When Checking Your Balance

- Tips for Managing Your Vanilla Visa Balance

- Security Measures to Protect Your Vanilla Visa

- Conclusion: Mastering Your Vanilla Visa Balance

References: - Vanilla Visa Official Website - Consumer Financial Protection Bureau