Ever found yourself scratching your head trying to figure out how to check the balance of your Vanilla Card? You're not alone, my friend. Whether you're using this card for travel, gifts, or everyday purchases, keeping track of your balance is crucial. But don't worry, we've got you covered! In this article, we'll walk you through everything you need to know about checking your Vanilla Card balance, step by step.

Let’s face it, life gets hectic sometimes, and managing finances can feel like a juggling act. That’s why having a clear understanding of how to check your Vanilla Card balance can save you time and stress. This article isn’t just about giving you instructions—it’s about empowering you with the tools you need to take control of your finances.

Before we dive into the nitty-gritty, let me remind you that your Vanilla Card is more than just a piece of plastic. It’s a powerful financial tool that, when used wisely, can help you achieve your goals. So, buckle up and let’s get started on mastering the art of balance checking!

Read also:Ayce Sushi The Ultimate Allyoucaneat Sushi Experience

Why Checking Your Vanilla Card Balance Matters

Let’s be real here—ignorance isn’t bliss when it comes to your finances. Knowing your Vanilla Card balance is essential for budgeting, avoiding overspending, and ensuring you’re getting the most out of your card. But why does it matter so much?

First off, staying on top of your balance helps you plan ahead. Imagine heading to a store or booking a flight only to realize your card doesn’t have enough funds. Not exactly the vibe you want, right? By checking your balance regularly, you can avoid these awkward moments and keep your financial life running smoothly.

What Happens If You Don’t Check Your Balance?

Skipping the balance check might seem harmless, but it can lead to bigger problems down the road. For instance, you might end up overcharging your card, which could result in declined transactions or even fees. No one likes surprises, especially when they’re financial ones!

Plus, keeping an eye on your balance can help you spot any unauthorized transactions or errors. Security is key, and being proactive about monitoring your account is the best way to protect yourself.

How to Check Balance of Vanilla Card: Step-by-Step

Alright, let’s cut to the chase. Here’s how you can check the balance of your Vanilla Card in just a few simple steps. Spoiler alert: it’s easier than you think!

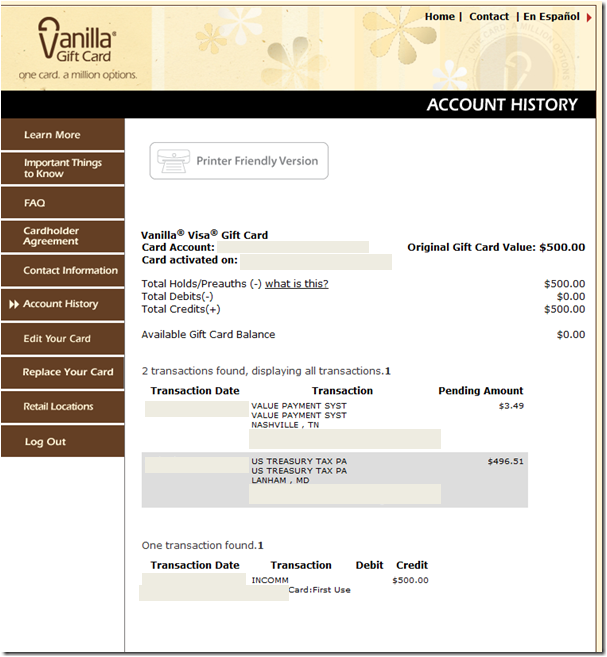

Option 1: Check via the Vanilla Card Website

One of the most convenient ways to check your balance is through the official Vanilla Card website. Follow these steps:

Read also:Why Puttshack Philly Is The Ultimate Spot For Fun And Games

- Head over to the Vanilla Card website.

- Click on the "Check Balance" or "Account Login" button.

- Enter your card number and any required security details.

- Voila! Your balance will be displayed in no time.

Make sure you’re using a secure connection when accessing the website, especially if you’re on public Wi-Fi. Safety first, always!

Option 2: Use the Vanilla Card App

Who doesn’t love convenience? The Vanilla Card app makes balance checking a breeze. Here’s how:

- Download the Vanilla Card app from the App Store or Google Play.

- Sign in with your credentials.

- Tap on the "Balance" section to see your current funds.

Not only does the app let you check your balance, but it also provides transaction history and other useful features. It’s like having a financial assistant in your pocket!

Common Mistakes to Avoid When Checking Your Balance

Even the best of us make mistakes, but when it comes to finances, it pays to be extra careful. Here are some common pitfalls to avoid:

- Forgetting to Log Out: Always log out of your account after checking your balance, especially on shared devices.

- Using Unsecured Networks: Avoid accessing your account on public Wi-Fi without proper protection.

- Ignoring Transaction History: Don’t just focus on the balance—take a moment to review your transaction history for any discrepancies.

By steering clear of these mistakes, you’ll keep your finances secure and stress-free.

Understanding the Vanilla Card: A Quick Overview

Before we go any further, let’s take a quick detour to understand what makes the Vanilla Card so special. This prepaid card offers flexibility, security, and convenience all rolled into one. Whether you’re using it for personal or business purposes, it’s a game-changer.

Here’s a snapshot of what you can expect from your Vanilla Card:

- No credit checks required.

- Reloadable for ongoing use.

- Accepted wherever Mastercard is accepted.

With features like these, it’s no wonder so many people are turning to the Vanilla Card for their financial needs.

Who Can Benefit from a Vanilla Card?

Whether you’re a student, traveler, or small business owner, the Vanilla Card has something for everyone. It’s perfect for:

- People who prefer prepaid options over traditional credit cards.

- Those looking to control their spending with a set budget.

- Anyone who wants the convenience of a digital wallet without the hassle.

So, whether you’re buying groceries or booking a trip, the Vanilla Card has got you covered.

Security Tips for Vanilla Card Users

Security should always be top of mind when managing your finances. Here are some tips to keep your Vanilla Card safe:

- Set Up Alerts: Enable transaction alerts to stay informed about any activity on your card.

- Monitor Regularly: Check your balance and transaction history frequently to catch any issues early.

- Protect Your PIN: Never share your PIN with anyone, and avoid writing it down.

By following these simple tips, you’ll ensure your Vanilla Card remains a secure and reliable tool for all your financial needs.

What to Do If Your Card Is Compromised

Unfortunately, no system is completely foolproof. If you suspect your Vanilla Card has been compromised, act fast:

- Contact Vanilla Card customer support immediately.

- Freeze your card to prevent further unauthorized transactions.

- Request a replacement card if necessary.

Time is of the essence when it comes to protecting your finances, so don’t hesitate to take action if something seems off.

Benefits of Regularly Checking Your Vanilla Card Balance

Now that we’ve covered the basics, let’s talk about why regularly checking your balance is such a good idea:

- Better Budgeting: Knowing your balance helps you plan your expenses more effectively.

- Prevents Overspending: You’ll avoid the embarrassment of declined transactions.

- Enhanced Security: Regular checks allow you to catch any suspicious activity quickly.

These benefits add up to a more organized and stress-free financial life. Who wouldn’t want that?

How Often Should You Check Your Balance?

The frequency of balance checks depends on how often you use your card. If you’re making daily purchases, checking your balance once a day might be ideal. For less frequent users, a weekly check should suffice. The key is consistency—find a schedule that works for you and stick to it.

Alternatives to Checking Your Balance Online

Not everyone is comfortable checking their balance online, and that’s okay. Here are a few alternative methods:

Option 1: Phone Support

Calling Vanilla Card customer support is a reliable way to get your balance information. Just be prepared to provide some security details to verify your identity.

Option 2: SMS Alerts

Some users prefer receiving SMS alerts for balance updates. Check with Vanilla Card to see if this service is available in your area.

Troubleshooting Common Issues

Even with the best tools, issues can arise. Here’s how to handle some common problems:

- Forgotten PIN: Contact customer support to reset your PIN.

- Unable to Log In: Double-check your credentials and try again. If the problem persists, reach out to support.

- Transaction Discrepancies: Report any suspicious activity to Vanilla Card immediately.

Remember, help is just a phone call away if you run into any trouble.

Conclusion: Take Control of Your Vanilla Card Balance Today

Checking your Vanilla Card balance doesn’t have to be a chore. With the right tools and a bit of know-how, you can stay on top of your finances like a pro. From using the official website to downloading the app, there are plenty of ways to make balance checking easy and convenient.

So, what are you waiting for? Take the first step today and start checking your balance regularly. Your future self will thank you for it. And hey, don’t forget to share this article with your friends—knowledge is power, after all!

Table of Contents

- Why Checking Your Vanilla Card Balance Matters

- How to Check Balance of Vanilla Card: Step-by-Step

- Common Mistakes to Avoid When Checking Your Balance

- Understanding the Vanilla Card: A Quick Overview

- Security Tips for Vanilla Card Users

- Benefits of Regularly Checking Your Vanilla Card Balance

- Alternatives to Checking Your Balance Online

- Troubleshooting Common Issues

- Conclusion

Hope this guide helps you master the art of balance checking! Let us know in the comments if you have any questions or tips of your own.