Let’s face it, folks—Vanilla Visa cards are becoming a go-to option for gift-giving, budgeting, or even paying for small purchases. But here’s the deal: knowing how to check the balance on your Vanilla Visa card is crucial to avoid unpleasant surprises when you’re ready to use it. Whether you’ve just received one as a gift or you’re using it for personal expenses, understanding how to track your balance can save you a lot of hassle. In this guide, we’ll walk you through every step of the process, from the basics to some advanced tips.

Now, before we dive in, let’s talk about why checking your Vanilla Visa balance matters. Imagine this scenario: you’re at your favorite store, ready to buy that cool gadget you’ve been eyeing, only to discover your card doesn’t have enough funds. Not fun, right? That’s why staying on top of your balance is essential. Plus, it’s super easy once you know how!

So, whether you’re a first-time Vanilla Visa user or you’ve been using these cards for years, this guide will give you the confidence to manage your funds like a pro. Let’s get started!

Read also:Roseville Golfland Sunsplash Your Ultimate Guide To Family Fun

Why Checking Your Vanilla Visa Balance Matters

Vanilla Visa cards are prepaid debit cards, which means they don’t have an endless supply of funds. Unlike credit cards, you can’t just swipe and worry about the bill later. Every transaction comes directly from the balance loaded onto the card. That’s why keeping tabs on your balance is so important.

Here’s the thing: if you overspend, you might face declined transactions or even fees for insufficient funds. Nobody wants that! By regularly checking your Vanilla Visa balance, you ensure you’re always aware of how much money is available. It’s like having a mini financial dashboard in your pocket.

Plus, checking your balance helps you avoid unnecessary stress. Knowing exactly how much you have left gives you peace of mind, especially if you’re using the card for essential purchases or gifts. So, let’s break down the easiest ways to do it.

How to Check Balance on Vanilla Visa: Step-by-Step

Alright, now that we’ve covered the importance of monitoring your balance, let’s dive into the nitty-gritty of how to actually check it. There are several methods you can use, depending on what works best for you. Below, we’ll explore the most common and convenient options.

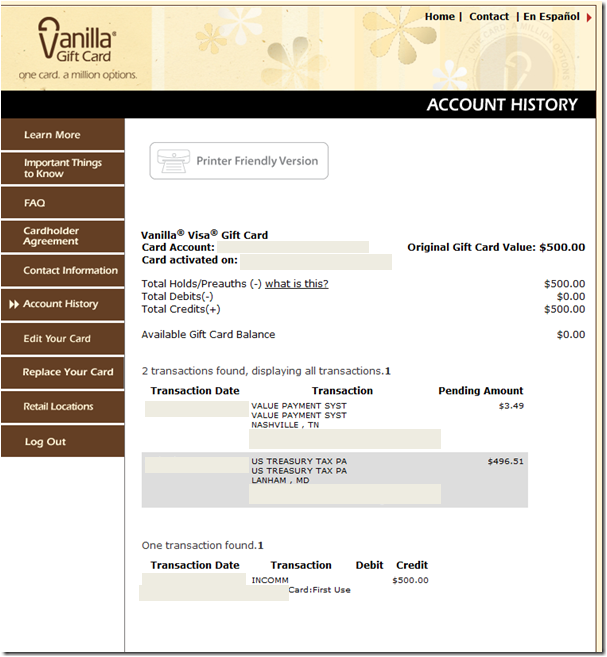

Method 1: Using the Vanilla Visa Card Website

This is probably the easiest and most straightforward way to check your balance. All you need is access to the internet and your card details. Here’s how it works:

- Head over to the official Vanilla Visa website.

- Click on the “Check Balance” option, which is usually located on the homepage.

- Enter your card number when prompted. Make sure to double-check the digits to avoid errors.

- Follow the on-screen instructions to view your current balance.

And there you go! You’ll have your balance right in front of you in no time. This method is great because it’s quick, secure, and available 24/7.

Read also:Tw Pornstar The Rise Of Talent Fame And Influence In The Digital Age

Method 2: Calling Customer Service

Not a fan of online processes? No problem! You can always call Vanilla Visa’s customer service hotline to check your balance. Here’s what you need to do:

- Grab the toll-free number from the back of your card or the official website.

- Dial the number and follow the automated prompts.

- When asked, provide your card number and any other required information.

- The system will then confirm your balance over the phone.

Calling customer service might take a bit longer than using the website, but it’s still a reliable option if you prefer speaking to someone or need additional assistance.

What to Do If Your Card Balance Is Incorrect

Let’s say you’ve checked your balance, but something seems off. Maybe the amount doesn’t match what you expected, or there’s a transaction you don’t recognize. Don’t panic—this happens more often than you’d think. Here’s what you should do:

- Contact Vanilla Visa customer service immediately. They’ll help you investigate any discrepancies.

- Have your purchase receipts handy in case they need to verify transactions.

- Be patient and detailed when explaining the issue. The more information you provide, the faster they can resolve the problem.

Remember, Vanilla Visa takes security seriously. If there’s ever a case of fraud or unauthorized transactions, they’ll work with you to rectify the situation.

Tips for Managing Your Vanilla Visa Balance

Knowing how to check your balance is just the beginning. To truly master your Vanilla Visa card, here are a few tips to keep in mind:

Tip 1: Track Your Spending

Write down every transaction you make with your card. This way, you’ll have a clear picture of where your funds are going. You can use a simple notebook or a budgeting app to keep track.

Tip 2: Set Spending Limits

Decide in advance how much you want to spend on specific categories, like groceries or entertainment. Sticking to these limits will help you avoid running out of funds unexpectedly.

Tip 3: Reload When Necessary

If you find yourself running low on funds, consider reloading your card. Most Vanilla Visa cards allow you to add more money easily, either online or through authorized retailers.

Common Questions About Checking Vanilla Visa Balance

Got some burning questions about Vanilla Visa balances? Don’t worry—we’ve got you covered. Here are some frequently asked questions:

Q1: Can I check my balance without entering my card number?

Unfortunately, no. To protect your account, Vanilla Visa requires you to enter your card number to verify your identity before showing your balance.

Q2: Is there a fee for checking my balance?

Nope! Checking your balance is completely free, whether you do it online or over the phone. However, be mindful of any fees associated with reloading or using your card.

Q3: What happens if I lose my card?

If you lose your card, contact Vanilla Visa customer service immediately to report it. They’ll deactivate the lost card and issue a replacement if necessary.

The Benefits of Using a Vanilla Visa Card

Now that we’ve covered balance checking, let’s talk about why Vanilla Visa cards are such a popular choice. Here are a few benefits:

- No credit checks: Anyone can use a Vanilla Visa card, regardless of their credit history.

- Flexible spending: Use your card wherever Visa is accepted, both online and in-store.

- Great for gifts: They make perfect presents for friends and family who love shopping.

- Easy to reload: Running low on funds? Simply add more money whenever you need to.

These cards offer convenience and flexibility, making them ideal for a variety of situations.

Security Features of Vanilla Visa Cards

When it comes to prepaid debit cards, security is a top priority. Vanilla Visa cards come with several features to protect your funds:

- Encryption technology: Your card information is encrypted to prevent unauthorized access.

- 24/7 fraud monitoring: Vanilla Visa keeps an eye on your transactions to detect any suspicious activity.

- Zero liability policy: If your card is lost, stolen, or used fraudulently, you won’t be held responsible for unauthorized charges.

With these safeguards in place, you can use your Vanilla Visa card with confidence.

Alternatives to Vanilla Visa Cards

While Vanilla Visa cards are great, they’re not the only prepaid option out there. If you’re exploring alternatives, here are a few worth considering:

Option 1: Green Dot Cards

Green Dot offers similar features to Vanilla Visa but with additional perks like direct deposit and bill pay services.

Option 2: Netspend Cards

Netspend is another popular choice, known for its customizable reload options and mobile app functionality.

Option 3: American Express Prepaid Cards

For those who want a bit more prestige, American Express offers prepaid cards with exclusive benefits and rewards.

Ultimately, the best card for you depends on your specific needs and preferences. Do your research and choose the one that aligns with your lifestyle.

Final Thoughts: Take Control of Your Vanilla Visa Balance

Alright, folks, that wraps up our guide on how to check your balance on a Vanilla Visa card. As you’ve learned, it’s a simple process that can save you a lot of headaches in the long run. By staying informed about your funds, you’ll avoid unpleasant surprises and make the most out of your card.

So, here’s the deal: don’t just stop at checking your balance. Use the tips and tricks we’ve shared to manage your card effectively. Whether you’re tracking your spending, setting limits, or reloading when necessary, taking control of your finances is empowering.

Before you go, we’d love to hear from you! Have you used a Vanilla Visa card before? What’s your favorite method for checking your balance? Leave a comment below and let’s chat. And if you found this guide helpful, don’t forget to share it with your friends and family. Until next time, stay savvy and keep those balances in check!

Table of Contents

- Why Checking Your Vanilla Visa Balance Matters

- How to Check Balance on Vanilla Visa: Step-by-Step

- What to Do If Your Card Balance Is Incorrect

- Tips for Managing Your Vanilla Visa Balance

- Common Questions About Checking Vanilla Visa Balance

- The Benefits of Using a Vanilla Visa Card

- Security Features of Vanilla Visa Cards

- Alternatives to Vanilla Visa Cards

- Final Thoughts: Take Control of Your Vanilla Visa Balance