Let’s cut straight to the chase, folks. Vanilla Balance Visa is more than just a credit card—it’s your ticket to financial flexibility and convenience. If you’ve ever found yourself scratching your head wondering how to juggle bills, rewards, and travel plans without breaking the bank, you’re in the right place. Today, we’re diving deep into everything you need to know about Vanilla Balance Visa, and trust me, it’s going to be a game-changer.

Now, I get it—credit cards can sometimes feel like a complicated maze. But don’t sweat it. Whether you’re a seasoned pro or a first-timer, understanding Vanilla Balance Visa is simpler than you think. This guide is here to break it down step by step so you can make smarter financial decisions. So grab your favorite drink, settle in, and let’s get started.

But before we dive into the nitty-gritty, let’s address the elephant in the room. Why should you care about Vanilla Balance Visa? Well, my friend, this card isn’t just another piece of plastic in your wallet. It’s a tool that, when used wisely, can help you balance your finances, earn sweet rewards, and even plan that dream vacation. Sound good? Let’s go!

Read also:Thermatru Doors The Ultimate Guide To Enhancing Your Homes Security And Style

What Exactly is Vanilla Balance Visa?

Breaking It Down: The Basics

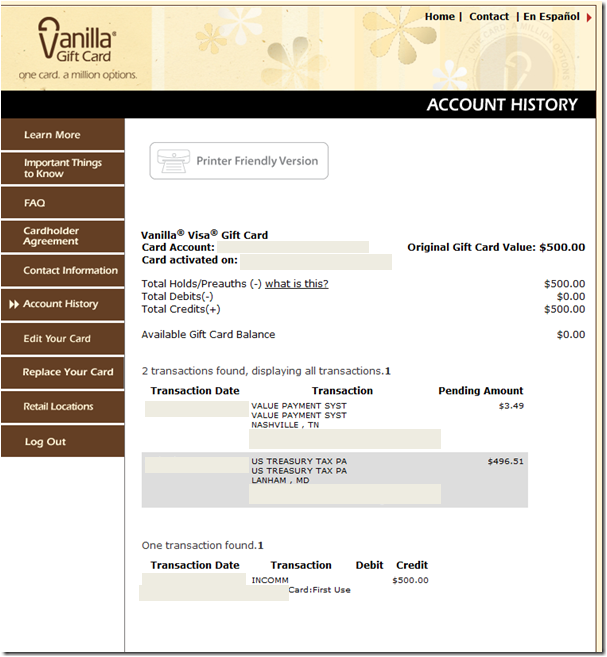

Alright, let’s start with the basics. Vanilla Balance Visa is a prepaid debit card that offers users the flexibility to manage their money without the hassle of traditional banking. Unlike regular credit cards, this baby doesn’t rely on credit scores or require you to go into debt. Instead, it works like a rechargeable wallet where you load funds onto the card and use it wherever Visa is accepted. Pretty neat, right?

Here’s the kicker: it’s perfect for anyone looking to take control of their finances. Whether you’re trying to stick to a budget, pay off existing debt, or simply avoid the temptation of overspending, Vanilla Balance Visa has got your back. Plus, it comes with perks like cashback, rewards programs, and even international transaction capabilities. Who wouldn’t want that?

Key Features You Need to Know

Let’s talk about what makes Vanilla Balance Visa stand out from the crowd. Here’s a quick rundown of its most awesome features:

- No Credit Check: Yep, you heard that right. You don’t need to worry about your credit score to get this card.

- Reloadable Funds: Load as much or as little as you want, whenever you want. It’s all about flexibility.

- Global Acceptance: Use it anywhere Visa is accepted, which is pretty much everywhere these days.

- Rewards Program: Earn points or cashback on your purchases, depending on the specific plan you choose.

- Mobile-Friendly: Manage your account on the go with the Vanilla Balance Visa app. It’s super convenient.

So, whether you’re shopping online, booking flights, or grabbing coffee at your favorite café, Vanilla Balance Visa makes life easier. And who doesn’t love a card that works as hard as you do?

Why Choose Vanilla Balance Visa Over Other Options?

Comparing the Competition

Let’s face it—there are a ton of prepaid cards out there. But what sets Vanilla Balance Visa apart? For starters, it’s all about simplicity. Unlike some cards that come with hidden fees or complicated terms, Vanilla Balance Visa keeps things straightforward. You know exactly what you’re signing up for, and there’s no fine print to trip you up.

Plus, it offers a level of security that many other prepaid cards can’t match. With features like fraud protection and real-time transaction alerts, you can rest easy knowing your money is safe. And let’s not forget the rewards program. Who doesn’t love earning points or cashback just for doing everyday shopping?

Read also:3 Little Figs The Ultimate Guide To This Trendy Spot Everyones Talking About

Who’s It Best For?

Vanilla Balance Visa isn’t just for one type of person. Whether you’re:

- A college student trying to manage expenses without going into debt,

- A parent looking to teach your kids about financial responsibility,

- Or someone who just wants a simple, hassle-free way to pay for things,

this card has something for everyone. It’s versatile, user-friendly, and packed with features that make managing your finances a breeze.

How to Get Started with Vanilla Balance Visa

Step-by-Step Guide

Ready to sign up? Here’s how you can get started:

- Visit the official Vanilla Balance Visa website or download the app.

- Choose the plan that suits your needs best—whether it’s the basic plan or the premium one with extra perks.

- Fill out the application form. Don’t worry, it’s quick and easy.

- Load your card with funds using your bank account or direct deposit.

- Start swiping! Use your card wherever Visa is accepted.

And that’s it! In no time, you’ll be on your way to enjoying all the benefits Vanilla Balance Visa has to offer. Easy peasy, right?

Managing Your Finances with Vanilla Balance Visa

Tips and Tricks for Maximum Efficiency

Now that you’ve got your card, how do you make the most of it? Here are a few tips to help you get the most bang for your buck:

- Set a Budget: Use the app to track your spending and stay within your limits.

- Automate Reloads: Set up automatic reloads from your bank account to avoid running out of funds.

- Maximize Rewards: Keep an eye on the categories where you earn the most points or cashback.

- Monitor Transactions: Regularly check your account for any suspicious activity.

By following these tips, you’ll be well on your way to mastering Vanilla Balance Visa and taking control of your financial future.

Common Misconceptions About Vanilla Balance Visa

Debunking the Myths

There are a lot of misconceptions floating around about prepaid cards in general, and Vanilla Balance Visa is no exception. Let’s clear up some of the biggest ones:

- Myth #1: It’s only for people with bad credit. Fact: Anyone can benefit from Vanilla Balance Visa, regardless of their credit score.

- Myth #2: It’s expensive to use. Fact: Many plans come with low or no fees, making it a cost-effective option.

- Myth #3: It’s not secure. Fact: Vanilla Balance Visa offers top-notch security features to protect your money.

So, don’t let these myths scare you off. Vanilla Balance Visa is a solid choice for anyone looking to manage their finances smarter.

Real-World Success Stories

How Others Are Winning with Vanilla Balance Visa

Don’t just take my word for it—here’s what some real users have to say about Vanilla Balance Visa:

“I used to struggle with keeping track of my expenses, but Vanilla Balance Visa has been a lifesaver. The app makes it so easy to monitor my spending and stick to my budget.” – Sarah M.

“As a frequent traveler, I love that I can use my Vanilla Balance Visa anywhere in the world. Plus, the rewards program has helped me save a ton on my trips.” – John D.

These stories show that Vanilla Balance Visa isn’t just a theoretical solution—it’s a practical tool that’s helping real people achieve financial success.

Vanilla Balance Visa vs. Traditional Credit Cards

Weighing the Pros and Cons

So, how does Vanilla Balance Visa stack up against traditional credit cards? Let’s break it down:

| Feature | Vanilla Balance Visa | Traditional Credit Cards |

|---|---|---|

| Credit Check Required | No | Yes |

| Interest Rates | None | Varies |

| Rewards Program | Yes | Yes |

| Security Features | High | High |

As you can see, Vanilla Balance Visa offers many of the same benefits as traditional credit cards, but without the drawbacks like interest rates and credit checks. It’s a win-win situation.

Tips for Maximizing Your Vanilla Balance Visa Experience

Leveling Up Your Game

Want to take your Vanilla Balance Visa experience to the next level? Here are a few advanced tips:

- Use the card for recurring payments like subscriptions and utility bills to simplify your life.

- Take advantage of promotional offers and limited-time rewards to earn even more points.

- Set up custom alerts for specific transaction types to stay in the loop.

With these strategies, you’ll be a Vanilla Balance Visa pro in no time.

Conclusion: Time to Take Control of Your Finances

And there you have it, folks. Vanilla Balance Visa isn’t just another prepaid card—it’s a powerful tool for managing your finances and achieving financial freedom. From its user-friendly features to its robust security and generous rewards program, it’s a card that truly has something for everyone.

So, what are you waiting for? Sign up today and start reaping the benefits. And while you’re at it, don’t forget to share this article with your friends and family. Who knows? You might just help them discover their own path to financial success.

Got any questions or feedback? Drop a comment below and let’s chat. Until next time, stay sharp and keep those finances in check!

Table of Contents

- What Exactly is Vanilla Balance Visa?

- Why Choose Vanilla Balance Visa Over Other Options?

- How to Get Started with Vanilla Balance Visa

- Managing Your Finances with Vanilla Balance Visa

- Common Misconceptions About Vanilla Balance Visa

- Real-World Success Stories

- Vanilla Balance Visa vs. Traditional Credit Cards

- Tips for Maximizing Your Vanilla Balance Visa Experience

- Conclusion: Time to Take Control of Your Finances