So, you’ve probably heard about vanillavisa.com balance, right? If not, don’t worry—we’re about to dive deep into what it means, how it works, and why it matters to you. Whether you’re managing your finances, planning a trip, or just trying to keep track of your spending habits, understanding vanillavisa.com balance is crucial. This isn’t just some random term floating around; it’s a key player in the world of prepaid cards and financial management. So grab your favorite drink, get comfy, and let’s break this down together.

Now, before we dive headfirst into the nitty-gritty details, let’s clear the air. Vanillavisa.com balance isn’t just a website or a card—it’s a system designed to help you manage your money without the hassle of traditional banking. Think of it as your personal assistant for all things financial. It’s simple, straightforward, and oh-so-helpful when you need to keep tabs on your spending. Stick around, and we’ll show you why this could be a game-changer for your wallet.

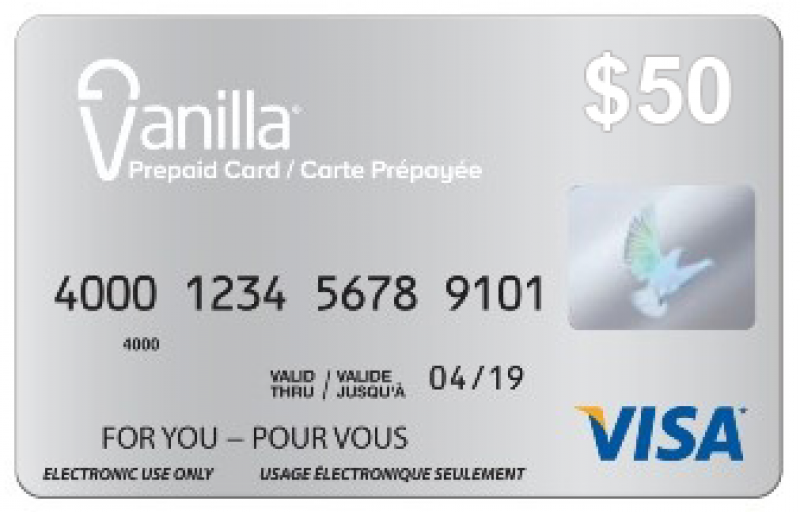

Here’s the deal: if you’ve ever felt lost in the maze of banking fees, credit card interest, or complicated account setups, vanillavisa.com balance might just be the answer you’ve been looking for. This prepaid Visa card allows you to load money onto it, spend it wherever Visa is accepted, and track your balance in real time. It’s like having a cash stash that works digitally, and trust me, that’s a big deal in today’s world. Ready to learn more? Let’s go!

Read also:Regal Valley View Grande The Ultimate Escape For Your Dream Getaway

What Exactly is Vanillavisa.com Balance?

Alright, let’s start with the basics. Vanillavisa.com balance refers to the available funds on your Vanilla Visa prepaid card. This card isn’t tied to a bank account, which makes it super convenient for people who don’t want the hassle of dealing with traditional banks. Instead, you load money onto the card, and that’s your spending limit. Simple, right? But there’s more to it than just loading and spending.

Here’s the kicker: vanillavisa.com balance isn’t just about tracking how much money you have on the card. It’s also about giving you control over your finances. You can check your balance online, set up alerts, and even freeze your card if you lose it. It’s like having a personal financial assistant in your pocket, and honestly, who wouldn’t want that?

How Does Vanillavisa.com Balance Work?

Now that we’ve covered what vanillavisa.com balance is, let’s talk about how it works. The process is pretty straightforward. First, you purchase a Vanilla Visa prepaid card from a retailer or online. Once you have the card, you can activate it and load funds onto it. From there, you can use the card wherever Visa is accepted, both online and in-store.

Here’s the cool part: every time you make a purchase, the amount is automatically deducted from your vanillavisa.com balance. You can check your balance anytime by logging into your account on the website or using the mobile app. Plus, you’ll get transaction notifications so you always know where your money is going. It’s like having a financial GPS!

Why Should You Care About Vanillavisa.com Balance?

Let’s be real for a second—money management can be stressful. Between bills, groceries, and unexpected expenses, it’s easy to lose track of where your money is going. That’s where vanillavisa.com balance comes in. By using this prepaid card, you can take control of your finances and avoid the pitfalls of traditional banking.

For starters, there are no overdraft fees because you can only spend what you’ve loaded onto the card. No more worrying about bouncing checks or maxing out your credit card. Plus, since the card isn’t tied to a bank account, you don’t have to worry about identity theft or unauthorized access. It’s like having a safety net for your money, and that’s priceless.

Read also:Jaiden Fatu The Rising Star In The Wrestling World

Key Benefits of Using Vanillavisa.com Balance

Let’s break down the top reasons why vanillavisa.com balance is worth considering:

- No monthly fees or maintenance charges

- Accepted worldwide wherever Visa is accepted

- Real-time balance tracking and transaction notifications

- Ability to reload funds easily through various methods

- Secure and convenient for online and in-store purchases

See what I mean? This isn’t just a card—it’s a tool that can help you stay on top of your finances. And in today’s world, that’s a huge advantage.

How to Check Your Vanillavisa.com Balance

Checking your vanillavisa.com balance is easier than you think. All you need is access to the internet or a smartphone. Here’s how you do it:

First, head over to the vanillavisa.com website and log into your account. If you haven’t set up an online account yet, you’ll need to do that first. Once you’re logged in, you’ll see a dashboard that shows your current balance, recent transactions, and other important info. You can also download the mobile app for on-the-go access to your account.

Tips for Managing Your Vanillavisa.com Balance

Now that you know how to check your balance, let’s talk about how to manage it effectively. Here are a few tips to keep your finances in check:

- Set a budget and stick to it

- Monitor your transactions regularly

- Reload your card in small increments to avoid overspending

- Use the card for specific expenses, like groceries or gas

- Take advantage of cashback offers when making purchases

By following these tips, you can make the most out of your vanillavisa.com balance and keep your financial goals on track.

Common Questions About Vanillavisa.com Balance

Before we move on, let’s address some of the most common questions people have about vanillavisa.com balance:

Can I use my Vanilla Visa card internationally? Absolutely! The card is accepted worldwide wherever Visa is accepted. Just make sure to check for any foreign transaction fees that may apply.

Is there a limit to how much I can load onto the card? Yes, there are limits depending on the type of card you have. For most Vanilla Visa cards, the maximum load limit is $5,000 per day and $25,000 per month.

Can I transfer money from my card to someone else? Currently, the card doesn’t support direct transfers to other accounts. However, you can withdraw cash from an ATM and give it to someone else if needed.

How Secure is Vanillavisa.com Balance?

Security is a top priority for vanillavisa.com. The card uses advanced encryption technology to protect your information, and you can freeze the card instantly if you ever lose it. Plus, since the card isn’t linked to a bank account, your personal financial information stays safe even if the card is compromised.

But wait, there’s more! You’ll also receive alerts for suspicious activity, so you can take action quickly if something seems off. It’s like having a security guard for your money, and that’s a pretty sweet deal if you ask me.

Who Should Use Vanillavisa.com Balance?

Vanillavisa.com balance is perfect for anyone looking for a simple, secure way to manage their money. Whether you’re a student, a traveler, or someone who just wants to avoid the hassle of traditional banking, this prepaid card has something to offer.

Here are a few examples of people who might benefit from using vanillavisa.com balance:

- Young adults who are just starting to build their credit

- Travelers who need a convenient way to access funds abroad

- People who want to avoid bank account fees and credit card debt

- Small business owners who need a separate card for expenses

No matter who you are, vanillavisa.com balance can help you take control of your finances and make smarter spending decisions.

Alternatives to Vanillavisa.com Balance

Of course, vanillavisa.com balance isn’t the only prepaid card option out there. If you’re considering other alternatives, here are a few to check out:

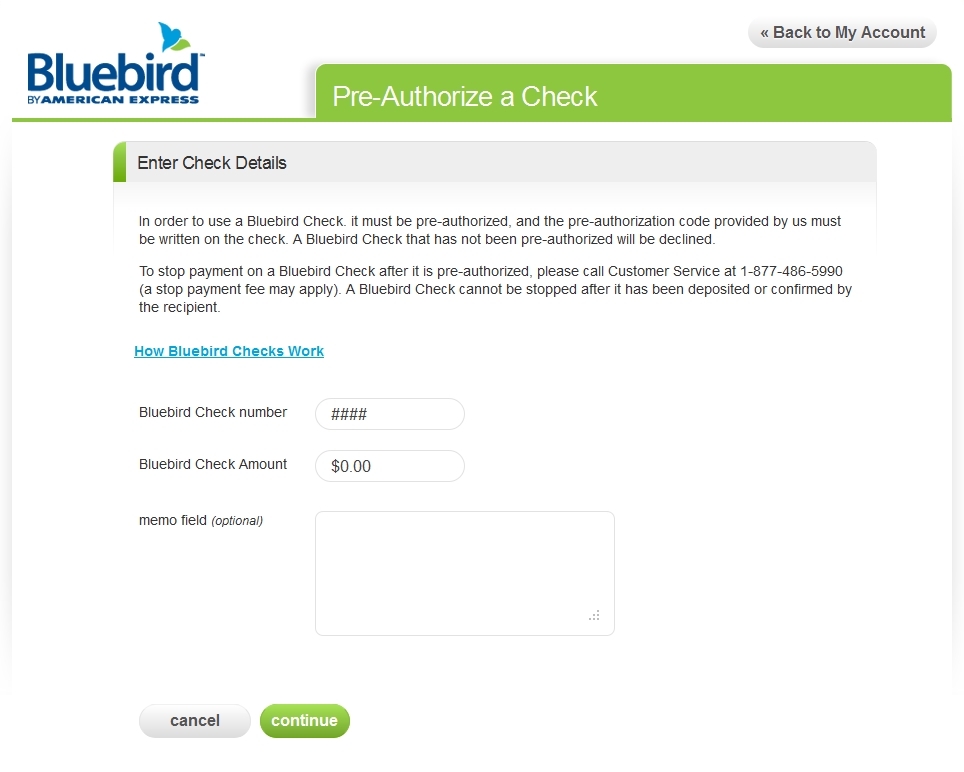

- Bluebird by American Express

- Green Dot Card

- NetSpend Visa Prepaid Card

- PayPal Cash Card

Each of these cards has its own unique features and benefits, so it’s worth doing some research to see which one fits your needs best. But if you’re looking for simplicity, security, and convenience, vanillavisa.com balance is definitely worth considering.

Vanillavisa.com Balance in the Real World

Let’s talk about how vanillavisa.com balance plays out in real life. Imagine this scenario: you’re planning a trip to Europe, and you want to avoid the hassle of carrying cash or dealing with foreign exchange fees. By loading your Vanilla Visa card with the funds you need for your trip, you can focus on enjoying your vacation without worrying about your money.

Or maybe you’re a college student trying to budget your expenses. With vanillavisa.com balance, you can load your card with a set amount each month and use it for things like groceries, textbooks, and entertainment. It’s like having a financial safety net that keeps you on track.

Testimonials from Real Users

Don’t just take my word for it—here’s what some real users have to say about vanillavisa.com balance:

“I love how easy it is to track my spending with this card. It’s been a game-changer for my budgeting.” – Sarah, 28

“As someone who travels a lot, I appreciate the security features and worldwide acceptance of my Vanilla Visa card.” – John, 35

“No fees, no hassle—it’s exactly what I needed to simplify my finances.” – Emily, 22

These testimonials show that vanillavisa.com balance is more than just a prepaid card—it’s a solution for real people with real financial needs.

Conclusion: Why Vanillavisa.com Balance Matters

In conclusion, vanillavisa.com balance is a powerful tool for managing your finances in today’s fast-paced world. Whether you’re looking to avoid bank fees, control your spending, or simply make your life easier, this prepaid card has something to offer. By understanding how it works and using it effectively, you can take control of your money and achieve your financial goals.

So, what are you waiting for? Head over to vanillavisa.com, grab a card, and start managing your balance like a pro. And while you’re at it, don’t forget to share this article with your friends and family. Who knows? You might just help them take control of their finances too.

Table of Contents

- What Exactly is Vanillavisa.com Balance?

- How Does Vanillavisa.com Balance Work?

- Why Should You Care About Vanillavisa.com Balance?

- Key Benefits of Using Vanillavisa.com Balance

- How to Check Your Vanillavisa.com Balance

- Tips for Managing Your Vanillavisa.com Balance

- Common Questions About Vanillavisa.com Balance

- How Secure is Vanillavisa.com Balance?

- Who Should Use Vanillavisa.com Balance?

- Alternatives to Vanillavisa.com Balance