Hey there, cardholders! Ever wondered about that mysterious three-digit (or four-digit) code on your American Express card? Yep, we’re talking about the CVV code. It’s more than just a random sequence of numbers; it’s your card’s secret handshake, ensuring safe transactions and protecting you from fraud. In this article, we’ll dive deep into everything you need to know about the CVV code on American Express cards, so buckle up and let’s get started!

Let’s face it—credit cards have become an essential part of our daily lives. Whether you’re shopping online, booking flights, or paying bills, your card is your go-to companion. But with the rise of digital transactions, security has become a top priority. This is where the CVV code steps in. It’s like the bouncer at a club, making sure only the right people get in.

Now, you might be thinking, “Why should I care about the CVV code?” Well, my friend, understanding how it works can save you from potential headaches down the line. In this article, we’ll break it all down for you, from what the CVV code is to how it keeps your transactions secure. So, without further ado, let’s jump right in!

Read also:Electric Picks The Ultimate Guide For Guitar Enthusiasts

What Exactly is a CVV Code?

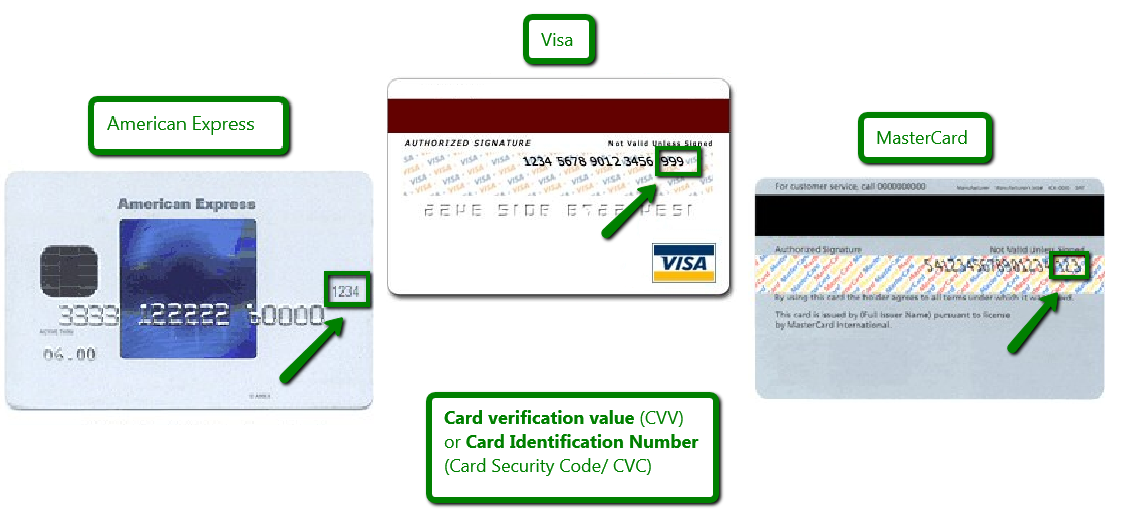

A CVV code, short for Card Verification Value, is a unique number printed on your credit or debit card. It acts as an extra layer of security during transactions, especially when you’re shopping online. Think of it as your card’s personal ID, verifying that you’re the rightful owner of the card.

For American Express cards, the CVV code is a four-digit number located on the front of the card, unlike other cards that usually have a three-digit code on the back. This small detail might seem insignificant, but it’s crucial when it comes to identifying your card during transactions.

Why is the CVV Code Important?

The CVV code plays a vital role in preventing fraudulent activities. When you make an online purchase, merchants often require the CVV code to ensure that the person making the transaction has the physical card in hand. It’s like a digital signature that confirms the authenticity of the transaction.

Moreover, the CVV code helps protect you from unauthorized transactions. If someone gets hold of your card number but not the CVV code, they won’t be able to complete the transaction. This added layer of security gives you peace of mind when using your American Express card.

Where to Find the CVV Code on an American Express Card

Now that you know what the CVV code is, let’s talk about where to find it on your American Express card. Unlike Visa or Mastercard, which have a three-digit code on the back, American Express cards have a four-digit code printed on the front, just above the card number.

Here’s a quick guide to help you locate it:

Read also:Baby Monkeys The Cutest Creatures Stealing Our Hearts

- Flip your card over and look for the signature strip. On American Express cards, you won’t find the CVV code there.

- Instead, turn the card back to the front and look for a small group of four numbers above the card number. That’s your CVV code!

How Does the CVV Code Work?

When you enter your CVV code during an online transaction, the merchant sends it to the payment processor for verification. The processor checks the code against the one on file with your bank to confirm that the transaction is legitimate.

Here’s a simplified breakdown of how the process works:

- You enter your card details, including the CVV code, on the merchant’s website.

- The merchant sends the information to the payment processor.

- The processor verifies the CVV code with your bank.

- If everything checks out, the transaction is approved. If not, it’s declined.

Common Myths About the CVV Code

There are a few misconceptions floating around about the CVV code, so let’s clear them up:

Myth 1: The CVV Code is Stored with Your Card Information

Fact: Merchants are not allowed to store your CVV code after a transaction. This ensures that even if their systems are compromised, your CVV code remains safe.

Myth 2: The CVV Code is the Same as Your PIN

Fact: While both are security measures, they serve different purposes. Your PIN is used for in-person transactions, while the CVV code is used for online or phone purchases.

Myth 3: The CVV Code is Optional

Fact: In most cases, the CVV code is required for online transactions. Skipping it can lead to declined transactions or security concerns.

Best Practices for Protecting Your CVV Code

Now that you understand the importance of the CVV code, here are some tips to keep it safe:

- Never share your CVV code with anyone, not even if they claim to be from your bank.

- Be cautious when entering your CVV code on public Wi-Fi networks. Use a secure connection whenever possible.

- Regularly monitor your card statements for any suspicious activity. If you notice anything unusual, report it to your bank immediately.

What Happens if Someone Gets Your CVV Code?

If someone gets hold of your CVV code, they could potentially make unauthorized transactions using your card. However, most banks have fraud protection measures in place to detect and prevent such activities.

Here’s what you should do if you suspect your CVV code has been compromised:

- Contact your bank immediately and report the issue.

- Request a new card with a different CVV code.

- Monitor your account closely for any unauthorized transactions.

How to Replace a Lost or Stolen American Express Card

If you lose your American Express card or it gets stolen, don’t panic. Here’s what you need to do:

- Call American Express’s customer service hotline as soon as possible to report the loss or theft.

- They will deactivate your current card and issue a replacement with a new CVV code.

- In the meantime, you can use American Express’s virtual card service to continue making transactions securely.

Why American Express Uses a Four-Digit CVV Code

While most credit cards use a three-digit CVV code, American Express opted for a four-digit code for added security. The extra digit increases the complexity of the code, making it harder for fraudsters to guess or replicate.

Here’s why the four-digit code is a game-changer:

- More combinations mean a lower chance of fraud.

- It sets American Express apart from other card providers, adding to its reputation for security.

Conclusion: Stay Safe and Stay Smart

So there you have it, folks! The CVV code on your American Express card is more than just a bunch of numbers—it’s your digital shield against fraud. By understanding how it works and following best practices, you can enjoy the convenience of online shopping without worrying about security.

Remember, never share your CVV code with anyone, and always keep an eye on your card statements. If you suspect any unauthorized activity, act fast and report it to your bank.

Now it’s your turn! Have any questions or tips about keeping your CVV code safe? Drop them in the comments below. And if you found this article helpful, don’t forget to share it with your friends and family. Stay safe out there!

Table of Contents

- What Exactly is a CVV Code?

- Why is the CVV Code Important?

- Where to Find the CVV Code on an American Express Card

- How Does the CVV Code Work?

- Common Myths About the CVV Code

- Best Practices for Protecting Your CVV Code

- What Happens if Someone Gets Your CVV Code?

- How to Replace a Lost or Stolen American Express Card

- Why American Express Uses a Four-Digit CVV Code

- Conclusion: Stay Safe and Stay Smart

![American Express CID (CVV) Code Guide [2022] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2021/03/Platinum-Card-CID.jpg)

![American Express CID (CVV) Code Guide [2022] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2021/03/Discover-CVV.jpg)