Let’s cut to the chase, folks—credit card security is no joke, and the CVV on an American Express card is like your digital shield. We’re diving deep into what this three-digit (or sometimes four-digit) number means, how it protects you, and why you should care about it. Whether you’re shopping online or protecting your finances, understanding your CVV is crucial. So, buckle up because we’re about to spill the tea on everything you need to know.

Ever wondered why every time you shop online, they ask for that mysterious number on the back of your card? That’s your CVV, or Card Verification Value, and for American Express users, it plays a vital role in securing your transactions. But what exactly is it? And why does American Express use a slightly different format than other cards? Stick around because we’re breaking it all down.

Now, I know what you’re thinking—“Why do I need to know this? Can’t I just swipe and forget?” Well, my friend, in today’s digital world, knowing the ins and outs of your credit card security can save you from some serious headaches. So, let’s dig in and make sure you’re fully armed with the knowledge to protect your finances.

Read also:Thermatru Doors The Ultimate Guide To Enhancing Your Homes Security And Style

What is a Credit Card CVV?

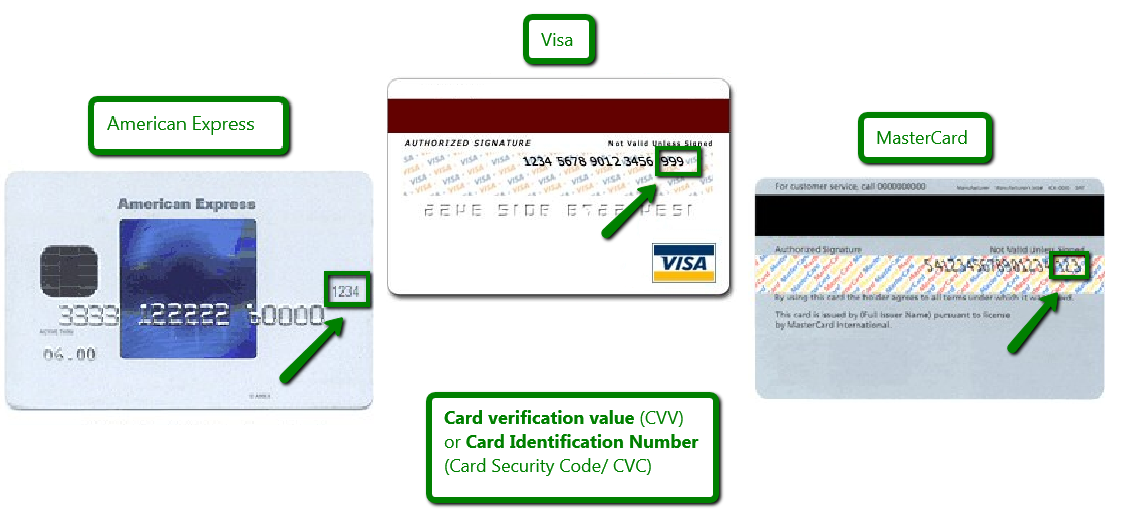

Let’s start with the basics, shall we? The CVV, or Card Verification Value, is a security code designed to protect you during online or phone transactions. It’s like your credit card’s ID badge, proving that you have the physical card in your possession. For most credit cards, including Visa and MasterCard, this is a three-digit number located on the back of the card. But American Express? Oh, they like to do things a little differently.

American Express uses a four-digit CVV, which they call the CID (Card Identification Number). This number is typically found on the front of the card, just above the card number. It’s a small detail, but one that can trip you up if you’re not aware of it. So, next time you’re entering your card details online, double-check where that number is hiding.

Why is the CVV Important for American Express?

Okay, so we know what the CVV is, but why is it so important? Well, the CVV acts as an extra layer of security for your transactions. When you enter this code during an online purchase, it confirms that you have the actual card in your hand. This helps prevent fraudsters from using stolen card numbers without the physical card.

For American Express, the CVV is especially critical because their cards often come with higher credit limits and are used for larger purchases. By requiring the CVV, they’re ensuring that only authorized users can make transactions. It’s like a digital handshake between you and the merchant, saying, “Yes, this is really me.”

Where to Find the CVV on an American Express Card

Now that we’ve established why the CVV is important, let’s talk about where to find it on your American Express card. Unlike other cards, the CVV on an AmEx card isn’t on the back—it’s right there on the front. Specifically, it’s a four-digit number located above the card number. Here’s a quick breakdown:

- Location: Front of the card, above the card number.

- Number of Digits: Four digits.

- Name: CID (Card Identification Number).

So, if you’re ever unsure, just flip your card over and check. If the number isn’t there, it’s probably on the front. Easy peasy.

Read also:Discovering The Spot Boulder A Climbers Dream Destination

How Does the CVV Protect You?

Alright, let’s talk about the real reason we’re here—the protection factor. The CVV is a powerful tool in your financial arsenal. By requiring this number for online transactions, merchants can verify that you have the physical card, making it much harder for fraudsters to use stolen card information.

Here’s how it works: When you enter your CVV during a transaction, the merchant sends it to the card issuer for verification. If the CVV doesn’t match the one on file, the transaction is denied. It’s like a digital password that only you and the card issuer know. This simple step can save you from a lot of trouble down the line.

Common Misconceptions About CVV

There are a few myths floating around about CVV numbers, so let’s clear the air. First off, your CVV is not stored with your card number in merchant databases. This means that even if a hacker gets ahold of your card number, they won’t have the CVV unless they physically steal your card. Another myth is that CVV numbers are random. In reality, they’re generated using a complex algorithm that only the card issuer knows.

What Happens If Someone Gets Your CVV?

Now, let’s address the elephant in the room. What happens if someone gets ahold of your CVV? Well, the short answer is that they could potentially use your card for unauthorized transactions. However, there are several safeguards in place to prevent this from happening. For one, most merchants limit the number of times you can enter the wrong CVV before the transaction is denied. Additionally, many card issuers, including American Express, offer zero liability protection, meaning you won’t be held responsible for fraudulent charges.

That said, it’s still important to keep your CVV safe. Never share it with anyone, and be cautious when entering it online. If you suspect your card information has been compromised, contact your card issuer immediately to freeze your account and get a new card.

How to Keep Your CVV Safe

Protecting your CVV is crucial for maintaining the security of your credit card. Here are a few tips to help you keep it safe:

- Don’t Write It Down: Memorize your CVV instead of writing it down somewhere. If you must write it down, keep it in a secure place.

- Be Cautious Online: Only enter your CVV on secure websites. Look for the padlock icon in the URL bar and ensure the website address starts with “https://”.

- Monitor Your Statements: Regularly check your credit card statements for any suspicious activity. If you see something unusual, report it immediately.

- Use Virtual Cards: Many card issuers offer virtual card numbers for online transactions. These numbers are linked to your actual card but have a different CVV, adding an extra layer of security.

By following these simple steps, you can significantly reduce the risk of your CVV falling into the wrong hands.

Can You Change Your CVV?

Here’s a question that comes up a lot—can you change your CVV? The short answer is no, you can’t. The CVV is generated by the card issuer and is tied to your specific card. However, if you’re concerned about security, you can request a new card with a different CVV. This is especially useful if you suspect your card information has been compromised.

Keep in mind that getting a new card means updating any automatic payments or subscriptions linked to your old card. It’s a small inconvenience, but well worth it for the added security.

What to Do If Your CVV is Stolen

Let’s say the worst happens, and your CVV is stolen. What do you do? First, don’t panic. Most card issuers, including American Express, have robust fraud protection measures in place. Here’s what you should do:

- Contact Your Card Issuer: Call your card issuer immediately and report the theft. They’ll likely freeze your account and issue you a new card.

- Monitor Your Accounts: Keep a close eye on your credit card statements and bank accounts for any suspicious activity.

- File a Report: If you believe your identity has been stolen, file a report with the authorities and consider placing a fraud alert on your credit report.

Remember, acting quickly is key to minimizing the damage.

Why American Express Stands Out in CVV Security

American Express has long been known for its commitment to security, and their approach to CVV is no exception. By using a four-digit CVV instead of the standard three, they add an extra layer of complexity that makes it harder for fraudsters to guess. Additionally, their zero liability policy means you won’t be on the hook for any unauthorized charges.

But it’s not just about the CVV. American Express also offers advanced fraud detection tools, 24/7 monitoring, and personalized alerts to help keep your account safe. It’s this combination of features that makes American Express a leader in credit card security.

How American Express Detects Fraud

American Express uses a variety of methods to detect and prevent fraud. These include:

- Machine Learning: Advanced algorithms analyze your spending patterns to detect any unusual activity.

- Real-Time Alerts: Get notified immediately if a suspicious transaction is detected.

- 24/7 Monitoring: Their fraud detection team works around the clock to ensure your account is safe.

These measures help ensure that any fraudulent activity is caught early, minimizing the impact on you.

Conclusion

So, there you have it—everything you need to know about the CVV on your American Express card. From its location to its importance in protecting your finances, understanding your CVV is crucial in today’s digital world. Remember, keep your CVV safe, monitor your accounts regularly, and don’t hesitate to contact your card issuer if you suspect any issues.

Now, here’s the thing—if you found this article helpful, why not share it with a friend? Knowledge is power, and the more people know about credit card security, the safer we all are. And hey, while you’re at it, feel free to leave a comment or check out some of our other articles. Stay safe out there, folks!

Table of Contents:

- What is a Credit Card CVV?

- Why is the CVV Important for American Express?

- Where to Find the CVV on an American Express Card

- How Does the CVV Protect You?

- Common Misconceptions About CVV

- What Happens If Someone Gets Your CVV?

- How to Keep Your CVV Safe

- Can You Change Your CVV?

- What to Do If Your CVV is Stolen

- Why American Express Stands Out in CVV Security

![American Express CID (CVV) Code Guide [2022] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2021/03/Platinum-Card-CID.jpg)

![American Express CID (CVV) Code Guide [2022] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2021/03/Discover-CVV.jpg)