Ever wondered what CVV on Amex cards really is? If you're like most people, you've probably scratched your head at one point or another. CVV stands for Card Verification Value, and it's that little code on the back of your Amex card that adds an extra layer of security when making purchases. But hold up, there's more to it than just being a random set of numbers. This guide is here to break it down for you, so you'll never have to guess again.

Now, you might be asking yourself, why should I care about CVV on Amex cards? Well, my friend, in today's digital world, security is everything. Whether you're shopping online, booking flights, or even paying your bills, that tiny CVV code plays a big role in protecting your financial info. So, buckle up because we're diving deep into everything you need to know.

Before we get started, let me tell you something cool. This article isn't just another boring explanation of CVV codes. We're going to explore the ins and outs, the history, and even some tips to keep your Amex card safe. By the end of this, you'll be a CVV pro, ready to tackle any situation that comes your way. So, let's get to it!

Read also:Why Puttshack Philly Is The Ultimate Spot For Fun And Games

What Exactly is CVV on Amex Cards?

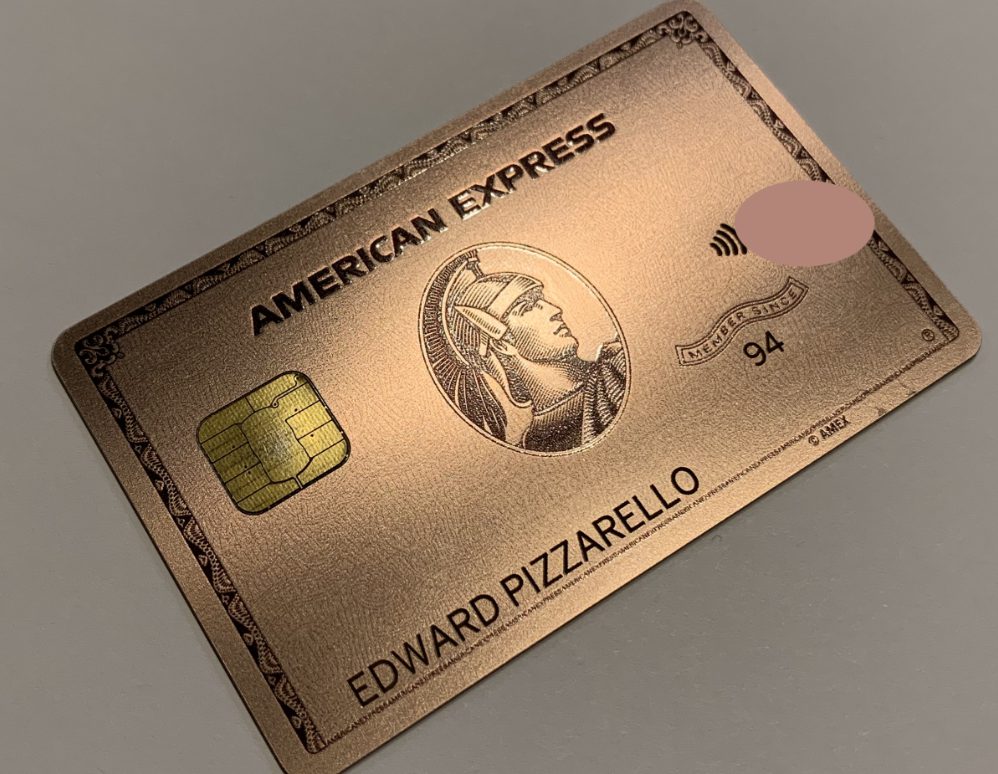

Alright, let's kick things off with the basics. CVV on Amex cards is essentially a security feature that helps verify that you're the rightful owner of the card during transactions. For Amex cards, this code is usually a four-digit number located on the front of the card, unlike Visa or Mastercard, which have three-digit codes on the back. This difference might seem small, but it's a key detail to remember.

Here's the deal: the CVV code is like a digital fingerprint for your card. It ensures that the person making the purchase has the physical card in their possession, reducing the risk of fraud. Think of it as your card's personal password. Without it, hackers or unauthorized users can't just swipe your card info and go on a shopping spree.

Why Does Amex Use a Four-Digit CVV?

You might be wondering why Amex decided to go with a four-digit CVV instead of the standard three. Well, it all comes down to security. The extra digit adds an additional layer of complexity, making it harder for fraudsters to guess or replicate the code. Plus, Amex has always been a bit of a trailblazer in the credit card world, so it's no surprise they chose to do things a little differently.

How Does CVV Work in Transactions?

Now that you know what CVV is, let's talk about how it actually works. When you make a purchase online or over the phone, the merchant will usually ask for your CVV code as part of the checkout process. This code is then sent to the payment processor, which verifies it against the info on file with your bank. If everything matches up, the transaction is approved. Simple, right?

But here's the kicker: the CVV code is never stored by the merchant. This means that even if their system gets hacked, your CVV info remains safe. It's like a secret handshake between you and your bank, ensuring that only authorized transactions go through.

Common Misconceptions About CVV

There are a few myths floating around about CVV codes, so let's clear those up. First off, some people think that CVV is the same as your PIN. Nope! Your PIN is used for in-person transactions at ATMs or card readers, while CVV is strictly for card-not-present transactions like online shopping. Another myth is that CVV codes can be guessed. While anything is possible with enough time and effort, the random nature of these codes makes it extremely unlikely.

Read also:Museum Of Illusions Promo Code Unlock Discounts And Unleash Your Curiosity

History of CVV on Credit Cards

Believe it or not, CVV codes have been around for quite a while. They were first introduced in the late 1980s as a way to combat the rising tide of credit card fraud. Back then, most transactions were done in person, so fraud was mainly limited to stolen or counterfeit cards. But as online shopping took off in the 1990s, CVV became an essential tool for verifying card ownership in a digital world.

Amex was one of the pioneers in adopting CVV technology, and they've continued to refine and improve it over the years. Today, CVV codes are a standard feature on virtually all credit and debit cards, helping to keep billions of transactions secure every year.

How CVV Has Evolved Over Time

As technology has advanced, so too has CVV. What started as a simple code printed on the back of a card has evolved into more sophisticated systems like dynamic CVV, which generates a new code for each transaction. This makes it virtually impossible for hackers to reuse stolen info. Amex has been at the forefront of this innovation, constantly pushing the boundaries of card security.

Steps to Protect Your CVV on Amex Cards

Now that you know how important CVV is, let's talk about how to keep yours safe. First and foremost, never share your CVV code with anyone. Not your best friend, not your mom, not even that "too good to be true" deal you found online. Treat it like your most guarded secret.

- Avoid writing down your CVV code or storing it digitally.

- Be cautious when entering your info on public Wi-Fi networks.

- Regularly monitor your account for any suspicious activity.

- Enable fraud alerts through your bank or card issuer.

These simple steps can go a long way in protecting your Amex card and ensuring that your CVV stays where it belongs – on your card.

Recognizing Phishing Scams

Phishing scams are one of the biggest threats to your CVV security. These scams often come in the form of fake emails or websites that look like they're from your bank or card issuer. They'll ask for your CVV code under the guise of verifying your account or updating your info. Don't fall for it! Legitimate companies will never ask for your CVV code via email or phone.

Alternatives to CVV for Added Security

While CVV is a great security feature, it's not the only tool in your arsenal. Many card issuers, including Amex, offer additional security measures like two-factor authentication, biometric verification, and virtual card numbers. These options can provide even more protection against fraud and unauthorized transactions.

For example, two-factor authentication requires you to enter a one-time code sent to your phone or email before completing a transaction. Biometric verification uses your fingerprint or facial recognition to confirm your identity. And virtual card numbers generate a temporary card number for each transaction, keeping your real info hidden.

Which Option is Right for You?

The best security option depends on your personal preferences and needs. If you're someone who shops online frequently, virtual card numbers might be the way to go. If you prefer a more hands-on approach, two-factor authentication could be the better choice. Whatever you decide, combining these methods with a strong CVV code can give you peace of mind knowing your info is protected.

Common Questions About CVV on Amex Cards

Let's tackle some of the most frequently asked questions about CVV on Amex cards. Chances are, if you're wondering about something, someone else has asked the same thing.

Can CVV Codes Be Reused?

Not exactly. While the same CVV code is used for multiple transactions, each transaction generates a unique digital signature. This makes it nearly impossible for fraudsters to reuse stolen CVV info.

What Happens if My CVV Code is Stolen?

If you suspect your CVV code has been compromised, contact your bank or card issuer immediately. They can issue you a new card with a fresh CVV code, ensuring your account remains secure.

Final Thoughts and Call to Action

So there you have it, the lowdown on CVV on Amex cards. From understanding what it is to learning how to protect it, you're now equipped with the knowledge to keep your financial info safe. Remember, security is a team effort. By staying vigilant and using all the tools at your disposal, you can enjoy the convenience of modern banking without worrying about fraud.

Now it's your turn! Did we answer all your questions about CVV on Amex cards? Is there something else you'd like to know? Leave a comment below or share this article with your friends. And if you're looking for more tips on staying safe in the digital world, check out some of our other articles. Stay safe out there!

Table of Contents

- What Exactly is CVV on Amex Cards?

- Why Does Amex Use a Four-Digit CVV?

- How Does CVV Work in Transactions?

- Common Misconceptions About CVV

- History of CVV on Credit Cards

- How CVV Has Evolved Over Time

- Steps to Protect Your CVV on Amex Cards

- Recognizing Phishing Scams

- Alternatives to CVV for Added Security

- Which Option is Right for You?

- Common Questions About CVV on Amex Cards