Ever wondered how to check your vanilla card balance without breaking a sweat? Well, you're not alone. Millions of people use vanilla prepaid cards for their convenience and flexibility. But let's face it—keeping track of your balance can sometimes feel like a maze. Don’t worry, though! We’ve got you covered with this ultimate guide to help you navigate the process like a pro.

In today's fast-paced world, managing finances has never been more important. Vanilla cards are a great tool for controlling spending and avoiding debt. But hey, knowing how to check that balance is key to staying on top of things. Whether you're using it for personal expenses or business transactions, understanding your card’s status is crucial.

This article will walk you through everything you need to know about checking your vanilla card balance. From simple steps to advanced tips, we’ll ensure you’re equipped with all the knowledge to handle your card like a boss. So, grab a coffee, sit back, and let’s dive in!

Read also:Lexus Of Maplewood Your Ultimate Destination For Luxury And Performance

Why Knowing Your Vanilla Card Balance Matters

Before we jump into the nitty-gritty, let’s talk about why keeping tabs on your vanilla card balance is so important. For starters, it helps prevent embarrassing moments at checkout counters when your card gets declined. Who wants that, right? Plus, staying informed about your balance allows you to budget better and avoid unnecessary fees.

Vanilla cards are often used as an alternative to traditional bank accounts. They offer a safe and secure way to manage money without the hassle of credit checks or monthly fees. But just like any financial tool, monitoring your balance ensures you’re making the most out of it.

How to Check Vanilla Card Balance: Step-by-Step

Checking your vanilla card balance doesn’t have to be rocket science. Here’s a quick rundown of the most common methods:

1. Online Account Access

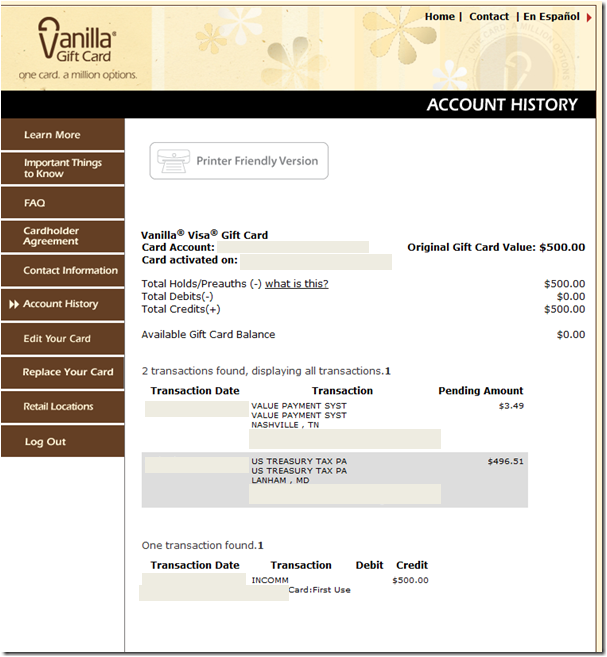

If you’ve registered your vanilla card online, accessing your balance is a breeze. Simply log in to your account and voila! Your balance will be right there for you to see. This method is super convenient and allows you to view your transaction history as well.

2. Mobile App Magic

Who doesn’t love a good mobile app? Many vanilla card providers offer apps that let you check your balance on the go. Just download the app, enter your credentials, and you’re good to go. It’s like having a personal finance assistant in your pocket.

3. Phone It In

Calling customer service might seem old-school, but it’s still a reliable option. Most vanilla card issuers have toll-free numbers you can use to check your balance. Plus, you can get answers to any other questions you might have while you’re at it.

Read also:Charleston Tea Garden Your Ultimate Guide To Americas Beloved Tea Plantation

Tips and Tricks for Checking Your Balance

Now that you know the basic methods, here are a few extra tips to make the process even smoother:

- Set up balance alerts so you never miss a beat.

- Regularly review your transaction history to spot any discrepancies.

- Keep your registration info updated for seamless access.

By incorporating these practices into your routine, you’ll have a better handle on your finances and avoid unpleasant surprises.

Common Mistakes to Avoid

Even the best of us make mistakes sometimes. Here are a few pitfalls to watch out for when checking your vanilla card balance:

One common error is forgetting to register your card online. Without this step, many features, including balance checking, won’t be available to you. Another mistake is neglecting to protect your account information. Always use strong passwords and avoid sharing your login details.

Understanding Vanilla Card Features

To truly master the art of checking your vanilla card balance, it helps to understand the card’s features. Most vanilla cards come with perks like cash reload options, direct deposit capabilities, and even rewards programs. Knowing what your card offers can enhance your overall experience.

Reload Options

Adding funds to your vanilla card is easier than ever. Many providers allow you to reload via bank transfers, mobile apps, or even retail locations. This flexibility makes managing your balance a whole lot simpler.

Direct Deposit Benefits

If your vanilla card supports direct deposit, take advantage of it! Not only does it ensure your paycheck lands in your account faster, but it also helps you keep track of your income and expenses more effectively.

Security Measures to Protect Your Balance

With the rise of digital transactions, security is more important than ever. Here are some steps you can take to safeguard your vanilla card balance:

- Enable two-factor authentication for added protection.

- Monitor your account regularly for suspicious activity.

- Report any unauthorized transactions immediately.

By staying vigilant, you can enjoy the convenience of your vanilla card without worrying about security risks.

Vanilla Card vs. Other Prepaid Cards

How does the vanilla card stack up against other prepaid options? Let’s break it down:

One of the biggest advantages of vanilla cards is their simplicity. They’re easy to use and don’t come with hidden fees. However, depending on your needs, other prepaid cards might offer features like overdraft protection or higher spending limits. It’s all about finding the right fit for your lifestyle.

Real-Life Success Stories

Don’t just take our word for it—real people are using vanilla cards to manage their finances successfully. Take Sarah, for example. She switched to a vanilla card after struggling with credit card debt. By tracking her balance and sticking to a budget, she was able to save over $500 in just six months. Inspiring, right?

Data and Statistics to Back It Up

According to a recent study, prepaid cards like vanilla have seen a 20% increase in usage over the past year. This trend shows no signs of slowing down, as more people turn to prepaid options for their financial needs. With stats like these, it’s clear that vanilla cards are here to stay.

Frequently Asked Questions About Vanilla Card Balances

Still have questions? Here are some answers to common queries:

Can I check my balance at an ATM?

Absolutely! Many vanilla cards allow you to check your balance at participating ATMs for free. Just make sure to select the “balance inquiry” option instead of withdrawing cash.

What happens if I lose my card?

No worries! Most vanilla card providers offer replacement services. Simply contact customer support to report your lost card and request a new one.

Are there fees for checking my balance?

Not usually. Most methods for checking your vanilla card balance are free. However, be sure to check your card’s terms and conditions to avoid any unexpected charges.

Conclusion: Take Control of Your Vanilla Card Balance

There you have it—everything you need to know about how to check your vanilla card balance. By following the steps outlined in this guide, you’ll be able to manage your finances with confidence and ease. Remember, knowledge is power, and staying informed about your balance is the first step toward financial success.

So, what are you waiting for? Start implementing these tips today and take control of your vanilla card. And don’t forget to share this article with friends who might find it helpful. Together, we can all become vanilla card masters!

Table of Contents

- Why Knowing Your Vanilla Card Balance Matters

- How to Check Vanilla Card Balance: Step-by-Step

- Tips and Tricks for Checking Your Balance

- Common Mistakes to Avoid

- Understanding Vanilla Card Features

- Security Measures to Protect Your Balance

- Vanilla Card vs. Other Prepaid Cards

- Real-Life Success Stories

- Data and Statistics to Back It Up

- Frequently Asked Questions About Vanilla Card Balances